Dreaming of launching your own business in North Carolina? Thousands of future entrepreneurs create LLC in North Carolina to transform their business concepts into operating businesses.

But here’s the truth:

Starting a business is exciting, but protecting it is essential.

Starting an LLC in North Carolina is an intelligent business step because it shields your assets and provides your organisation with legal benefits.

The easy formation process, coupled with a reasonable prices, attracts entrepreneurial minds in North Carolina who want to build a solid foundation.

Start an LLC for tangible advantages beyond protection measures alone. Setting up an LLC in NC provides your enterprise with enhanced reputation and tax benefits, as well as the freedom to grow according to your personal plan.

All businesses that wish to succeed can benefit from establishing an LLC in North Carolina.

Which essential steps are required to form an LLC in North Carolina? This guide will outline the complete procedure to establish your business venture with a defined understanding and self-assurance.

Table of Contents

- Why Choose an LLC?

- How to Form Your LLC in North Carolina

- Tips for Long-Term Success

- Conclusion and Next Steps

Why Choose an LLC?

Starting to operate a business creates both thrill and legal obligations. The LLC structure establishes both risk protection for your personal assets and foundation elements that lead businesses toward permanent achievement.

Protects Your Personal Assets

The business structure of an LLC separates your money from what your company owes. Your personal ownership of your home, together with your savings, will not be at risk because your business operates under an LLC structure. Every LLC grants automatic legal protection because it shields business owners from financial consequences that endanger their family assets.

Easy to Run and Manage

An LLC does not impose the advanced regulations that corporations need to follow. The operational requirements of annual meetings alongside strict bylaws and board of directors do not apply to LLCs. The structure enables owners to have better freedom regarding operational decisions without external restrictions. With their flexible nature LLCs work perfectly as an operational framework both for one-person ventures and small start-ups.

Flexible Tax Options

The tax option is flexible when starting a business as an LLC in North Carolina. All business structures are available for filing such as sole proprietorships alongside partnerships and corporations. The tax options offered through LLC structure provide owners with adjustable tax liabilities which enhance their ability to achieve financial targets. The main reason why business owners select pass-through taxation is to prevent double taxation and maintain simple profit distribution.

Low Startup Costs

Initiating an LLC operation in North Carolina comes at an inexpensive rate. Business owners who file an LLC in North Carolina typically do not require legal assistance since the fee remains at $125. You can start an investment venture either alone or with co-investors because the whole process remains affordable and accessible for beginners. The saved costs become available to fund marketing activities or increase inventory stock.

Professional Image

Adding “LLC” after your business name demonstrates both your professional commitment to your startup and your business readiness for standardised operations. A business operated under a formal trading name establishes superior business interactions that attract investment opportunities, along with partnership prospects.

Flexible Ownership

A person or various members have the capacity to create LLCS in North Carolina under its legal framework. Your business structure determines whether you run your LLC as a sole proprietorship or incorporate a team because the LLC format supports diverse organisational setups. Business expansion can easily bring new partners without requiring substantial legal modifications under the LLC business structure.

How to Form Your LLC in North Carolina

Step 1: Name Your North Carolina LLC

North Carolina business naming requirements, along with uniqueness in your business name, are essential to meet state standards. The company name must end with “LLC” or “Limited Liability Company” while also omitting any words that might suggest affiliation with government agencies.

The state offers an online tool to check for available business names in North Carolina:

👉 NC Business Entity Search

The public can reserve the name for 120 days by filing an application and paying a $30 fee, despite postponing formal filing. The reservation system prevents other parties from using the name during your name development process.

Helpful Hint: The solution to name selection trouble is to utilise online business name generators and group brainstorming sessions to choose a name that matches your vision and values.

Step 2: Appoint a Registered Agent

A registered agent is essential for each LLC permitted to operate in North Carolina. Your designated person or service will enact the reception of legal papers, together with official government mail, alongside tax-related notices.

Such an agent must either live in North Carolina or operate a business there, authorised under state law. You can serve the role of both an agent and a professional service.

Using a professional third-party agent protects your personal address confidentiality while receiving business hours delivery for vital documents.

More details here:

👉 Registered Agent Info – NC Secretary of State

Step 3: File the Articles of Organization

The Articles of Organization stand as the official document which creates your LLC legally. File Form L-01: Articles of Organization with the North Carolina Secretary of State through their submission portal.

You can submit the documents through online or mail channels. An LLC needs to pay $125 for the standard filing fee while processing typically requires a few days.

👉 File Online – North Carolina Business Registration

To send it through the mail, utilize the address noted on the form. After your approval, you will get confirmation, which enables your LLC to start operations legally.

Step 4: Create an Operating Agreement (Optional but Recommended)

The Operating Agreement details all managerial procedures of your LLC. The agreement specifies rules for ownership as well as roles, profits, dispute resolution and additional elements.

This business document should be in place even though it is not mandatory for LLCS operating in North Carolina. It becomes particularly beneficial for multiple-member entities. Such documents protect both clarity and member interests when disagreements occur within an LLC structure.

A single-member LLC receives the same value from an operating agreement since it defines business obligations. Keep an official record containing the signed documents for your possession.

Step 5: Get an EIN (Employer Identification Number)

A business requires the 9-digit EIN issued by the IRS to function as the equivalent of a Social Security Number. Every business must possess an EIN for tax compliance as well as bank account registration and labor workforce establishment.

The IRS provides complimentary EIN acquisition through their website where you can obtain the number within just a few minutes.

Business owners operating alone will eventually require an EIN for obtaining licenses or managing payroll taxes even if they have no staff.

Step 6: Apply for Business Licenses and Permits

Certain industries, alongside specific geographical locations, will require you to possess valid licenses for legal business operations in North Carolina. North Carolina requires various business licenses, including food service permits and construction licenses, daycare licenses, and others.

Every North Carolina business needs to validate its registration requirements at both the local city and county government offices. Contact your local Chamber of Commerce while you can also consult with the state website’s information.

When renewing licenses, keep yourself compliant while observing all laws defined by local authorities.

Step 7: File Your Annual Report

North Carolina LLCS must submit their annual report every year as it maintain official business data with state authorities. The state requires every LLC to submit accurate information about its business location, plus registered agent identification and organisational framework.

The filing deadline for this report exists on April 15 of each year with a required fee of $200. An online filing system speeds up the processing time.

👉 File Annual Report – NC Secretary of State

Refrain from missing deadline payments because it leads to penalties or administrative dissolution, so keep annual reminders to maintain good standing.

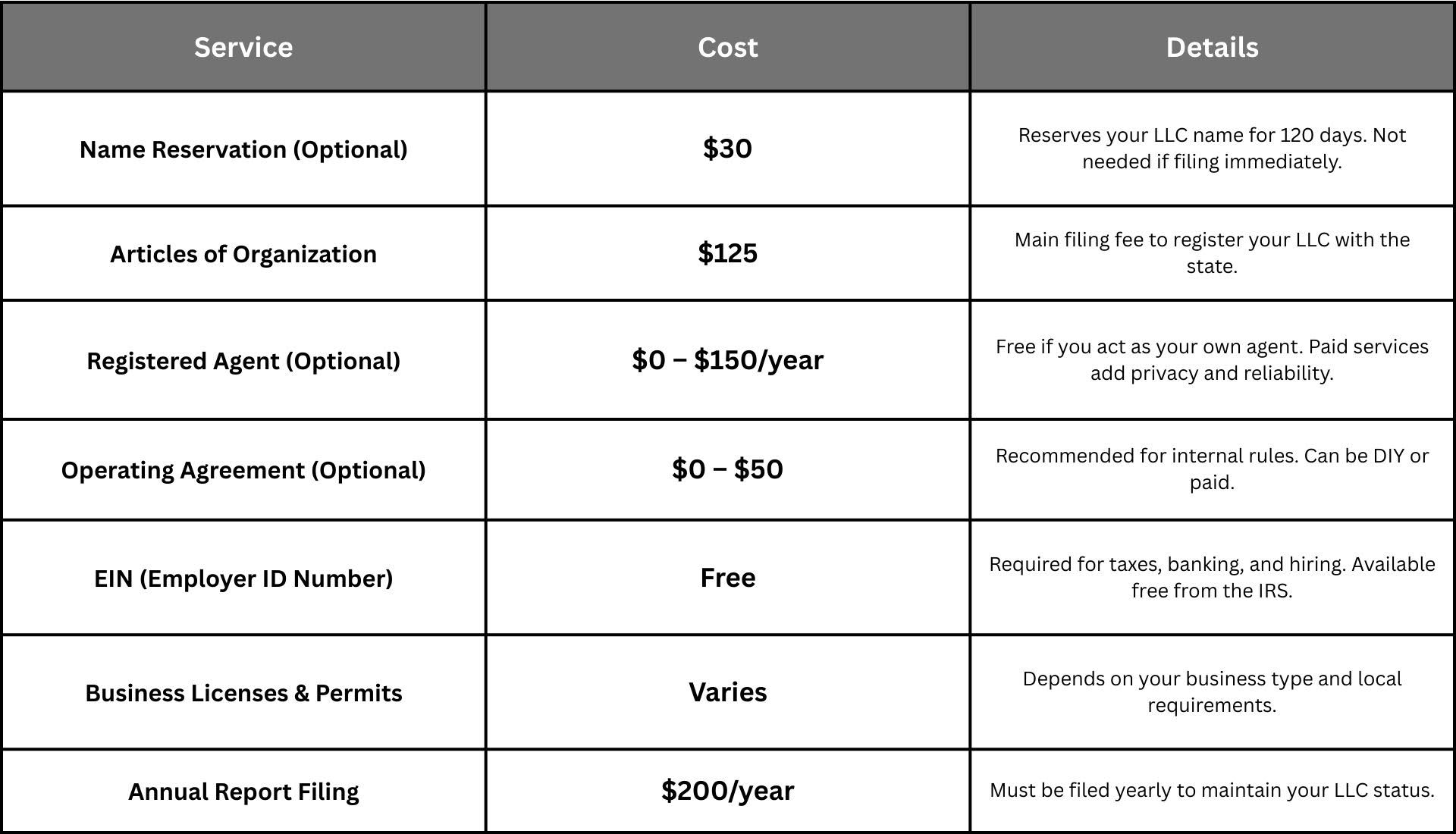

Breakdown of Costs for Forming an LLC in North Carolina

Tips for Long-Term Success

- Keep Personal and Business Finances Separate

You should open a business bank account followed by organizing your transactions. The combination of business and personal funds will destroy the available liability protection. - Track Important Deadlines

An app or calendar serves as your tool to monitor Annual Report deadlines together with license renewals. Your LLC’s good standing status faces possible adverse effects when you miss scheduled deadlines. - Review Your Operating Agreement Regularly

Your business development will cause your responsibilities and main objectives to transform. Assess your business agreement annually for modifications which are necessary. - Stay Compliant with State Regulations

Your business requires updated business licenses and the immediate response to state notifications for maintaining good standing. Your LLC functions optimally because of regular compliance maintenance. - Invest in Branding and Online Presence

A professional logo combined with a website and business email will help you establish trust through your LLC name. These boost your visibility and customer confidence.

Conclusion: Your Path to Business Success in North Carolina

Establishing an LLC enterprise in North Carolina serves as an exciting gateway for all business stakeholders. Legally forming as an LLC brings both legal safeguards and tax advantages and business professionalism which contributes to future achievement.

Your business will achieve a sound legal structure when you follow and finalize the required steps. From your name to your operating agreement, every detail counts.

North Carolina favours business growth for digital storefronts, local service providers, and freelance ventures.

Key Takeaways

- Legal Protection: Financial difficulties in your business cannot affect your personal property items.

- Simple Setup: The straightforward filing procedure, together with affordable prices, enables anyone to establish an LLC.

- Flexible Management: Business operators can determine operational parameters and tax schemes for their LLCS.

- Ongoing Responsibility: Your company requires annual submissions along with compliance to maintain good standing.