Dreaming of owning a business? Starting an LLC in Michigan can help you get started with confidence and security.

Start an LLC in Michigan. People can launch their business ventures with excitement from the start while guaranteeing proper legal structures at the same time.

Gaining business credibility through an LLC is an ideal solution for asset protection without compromising your company’s growth potential.

Creating a business through an LLC in Michigan comes with affordable formation procedures that ensure legal protection for personal assets. If you begin with an LLC structure option now or transition your current business into one, you will achieve long-term success with it.

How to start an LLC in Michigan? The detailed instructions will explore the process of establishing your own Michigan-based LLC with the goal of successful business initiation.

Table of Contents

- Why Choose an LLC?

- How to Form Your LLC in Michigan

- Tips for Long-Term Success

- Conclusion and Next Steps

Why Choose an LLC?

A new enterprise generates both thrilling prospects and significant dangers for its founders. Numerous individuals select the establishment of an LLC (Limited Liability Company) for its protection against personal assets. A legal business structure through an LLC provides your company with simplified protection and safety. The following benefits show that forming an LLC would suit your business needs.

Protects your personal assets

Your business problems such as money loss or being sued or having debt will not disturb your personal assets. Your house and car along with your savings remain untouchable when it comes to business debt payments. Under the law your LLC functions independently from you thus it bears responsibility for its own financial troubles.

Easy to run and manage

Formal requirements are minimal for LLCs since they lack the meeting and rule obligation of corporations. Operating your company according to your chosen methods becomes possible when paperwork requirements remain minimal. The simple functioning rules benefit both single business operators and independent entrepreneurs.

Choose how you want to pay taxes

An LLC holds flexibility regarding taxation options. When forming an LLC you can select taxation options either as a sole proprietor or partnership entity or as a corporate business structure. The tax setups allow you to select an arrangement that minimises your payment obligations according to your business objectives.

Affordable and simple to start

Business formation through opening an LLC in Michigan operates at an affordable cost without barriers. The filing process of an LLC costs just a $50 tax payment with easy and swift startup requirements. The standard process requires no lawyers because most people manage these steps independently.

Makes your business look more professional

Your business obtains formal recognition by appending “LLC” to its name. The use of LLC authorisation helps establish trust between business customers and other companies and financial institutions. Customers will see your business as a serious operation because you demonstrate both accountability and dedication towards your enterprise.

Start it alone or with others.

When operating as an LLC you can benefit from the structure both as an independent business owner or when maintaining a small groups of employees. A personal LLC may be initiated either as an individual solo venture or with added support from existing friends or family members or business associates. The organisational framework enables owners to build their own ownership structure.

How to Form Your LLC in Michigan

Step 1: Choose a Name for Your LLC

A business must select an original name which people will remember easily. The name needs to carry “LLC” or “Limited Liability Company” at its conclusion for official registration purposes. The chosen name needs to be different from all present business names that exist within Michigan.

You can use this search system to verify your preferred business title:

👉 Michigan Business Entity Search

You can reserve your company name for six months through a $25 payment before registering. The form requires you to complete it and send it by mail.

👉 Name Reservation Form (PDF)

Helpful Hint: Business name generators help businesses develop appropriate name options when they battle with providing distinct names to their companies.

Step 2: Appoint a Registered Agent

A business must have a registered agent who receives all essential legal documents including tax papers and legal notices. Every LLC operating in Michigan needs a registered agent to maintain its legal presence because this requirement exists in state law.

Every LLC must have a registered agent who can be you or a trusted friend or professional agent from a service company. All registered agent candidates must live in Michigan with an age of 18 years or older. A professional registered agent must maintain office hours at a physical location instead of using a P.O. box.

More info here:

👉 Registered Agent Info – Michigan LARA

Step 3: File the Articles of Organization

The main official document transforms your LLC into an official business entity. A business cannot exist legally unless you submit this filing document. The filing requirement in Michigan operates under two names known as “Articles of Organization” and Form CSCL/CD-700.

You may file this document through the Internet platform and by sending it through regular mail.

👉 File Online – Michigan Corporations Online Filing System

If you prefer paper, download and mail this form to the address mentioned on it:

👉 Articles of Organization – PDF

The total cost to establish your LLC starts at $50 with a single payment at startup. State authorization leads to business formation for your company after you send your approval confirmation.

Step 4: Create an Operating Agreement (Optional)

A document details the operations of your LLC. An Operating Agreement contains such details as ownership structure alongside responsibilities and decision-making authority and profit distribution methods.

The state of Michigan does not mandate this document but it remains essential to establish especially for multi-member LLCs. The document functions to prevent misunderstandings and disputes from occurring later on. The legal and professional image of your LLC improves through proper organizing procedures that protect your business from potential threats.

The document does not require submission to government agencies. Create the operating agreement through signatures followed by recordkeeping of the document.

Step 5: Get an EIN (Employer Identification Number)

A business requires an EIN similar to a Social Security Number which serves as its official identification. The 9-digit EIN serves as your IRS-issued tax identifier for financial transactions including employment management and banking purposes.

Your business requires an EIN to establish either a business bank account or apply for licenses even though you might not intend to employ anyone immediately.

You can obtain an EIN for free online within minutes by using this link:

👉 Apply for an EIN – IRS Website

Step 6: Get Business Licenses or Permits (If Needed)

Your business startup needs one or more licenses or permits based on its specific type. Running a salon or restaurant or daycare or construction business demands receiving specific local state licenses.

Contact your city or county department to understand which specific requirement you need. You can locate this website on the state website for general information:P

👉 Business Licenses & Permits – Michigan.gov

Step 7: File Your Annual Statement

Michigan law requires every Limited Liability Company to file an Annual Statement that maintains business activity and compliance status. The business details need confirmation through this minimal document.

Michigan requires every LLC including new post-September 30 registrants to file an Annual Statement before February 15 each year. Nonpayment of your Annual Statement will lead to the dissolution of your LLC by the state government.

The Annual Statement along with its $25 fee can be submitted through the provided online platform:

👉 File Annual Statement – LARA Website

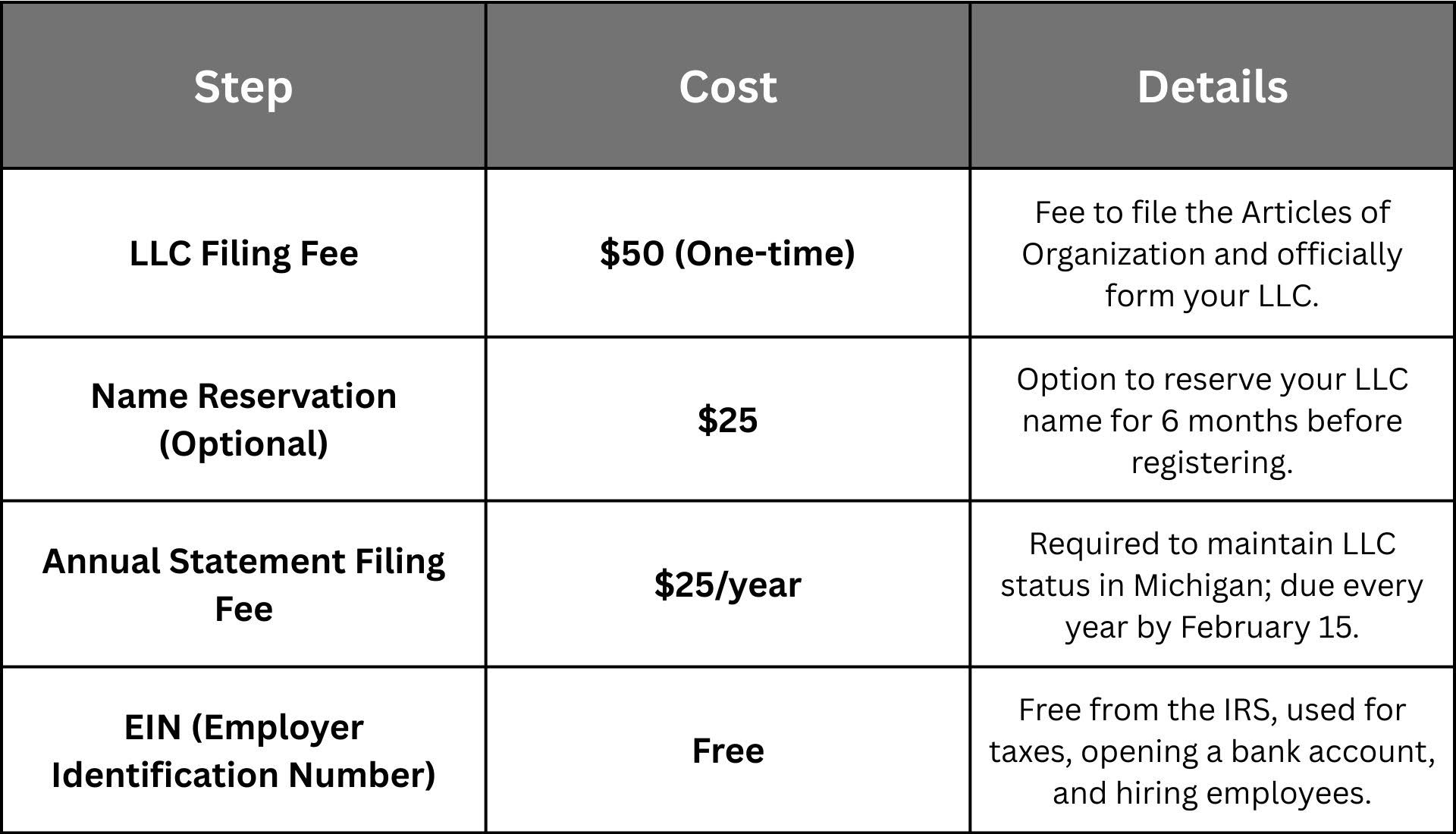

Breakdown of Costs for Forming an LLC in Michigan

Conclusion:

The steps described will allow you to set up your LLC safely in Michigan. The business structure provides asset protection to business owners together with flexible management features and potential tax breaks that make it suitable for entrepreneurs.Northwest Registered Agent

Key Takeaways:

- Legal Protection: As a business entity LLC protects your personal property from becoming responsible for business debts.

- Simplicity: The procedure to establish an LLC presents straightforward steps and costs reasonable fees.

- Flexibility: The LLC structure provides multiple choices for managing and taxation to fit different business requirements. Wolters Kluwer Solutions

- Ongoing Compliance: You need to file Annual Statements alongside maintaining licenses for your LLC to stay in good standing.

Your LLC creation marks only the first point of starting your business journey. Michigan’s dynamic market provides excellent opportunities for your business to succeed when you dedicate proper planning.