Thinking of starting a business in Texas?

Before you start an LLC in Texas, you need to learn Texas tax regulations before establishing your LLC. Texas supports businesses with its tax policy because there are no personal income taxes for residents, and limited taxes apply to LLC entities. You still have tax obligations, although state tax benefits exist for Texas business operations.

Starting an LLC in Texas requires that most LLCS prepare a franchise tax report annually, while revenue levels determine their tax liability. Every Texas LLC must file reports annually, regardless of unpaid tax obligations, to maintain good standing status. Creating an LLC in Texas requires comprehension of both federal tax rules and sales tax regulations, as well as employment tax implications when adding staff members.

This 2025 guide provides LLC operators and formers in Texas with complete details about taxes, including initial costs, annual report requirements and vital documentation and schedule information.

The following step-by-step explanation explains everything.

Table of Contents

- Why Choose an LLC in Texas?

- Understanding LLCS in Texas: Why It’s a Smart Move

- Step‑by‑Step Guide to Forming Your Texas LLC

- Costs & Tax Responsibilities of Starting an LLC in Texas

- Ongoing Requirements for Your LLC

- Who Can Start an LLC in Texas?

- Benefits of Launching an LLC in the Lone Star State

- Things to Consider: Potential Drawbacks of a Texas LLC

- What to Do After You’ve Set Up Your LLC in Texas

- Frequently Asked Questions (FAQS)

- Conclusion: Ensuring Your LLC is Legally Protected

Why Choose an LLC in Texas?

Liability Protection

Texas business owners who establish LLCs establish protection that safeguards their house and car and financial reserves from business liabilities. The personal assets of members who own LLCs remain protected when it comes to the business obligations of their LLC.

No State Income Tax

Individuals living in Texas are free from state income taxes, while most LLCs escape corporate income taxes in the state. The entity might need to pay the franchise tax based on its annual gross income rather than state income tax.

👉 Learn more from the Texas Comptroller’s Franchise Tax page

Tax Flexibility

Single-member LLCs automatically become taxed like sole proprietorships, while multi-member LLCs receive partnership taxation treatment. An LLC owner can request an S Corporation or C Corporation tax status from the IRS through proper form submissions.

Simple Management Structure

The Texas state laws do not enforce strict corporate formalities for LLCs. Small businesses benefit from day-to-day simplicity because LLCs in Texas have no annual meeting requirements or complex reporting obligations.

Professional Image

Your brand gains increased credibility through the establishment of an LLC. Forming an LLC proves to your clients and investors, as well as vendors, that your business is officially recognized in Texas.

For full legal guidance, visit the Texas Secretary of State – Business Services Division.

1. Understanding LLCs in Texas: Why It’s a Smart Move

What is an LLC?

An LLC combines features from both corporations, which protect owners from liability and partnerships, and sole proprietorships, which maintain straightforward operations. Texas locals choose LLCs because these entities let entrepreneurs maintain tax benefits and easy management together with personal asset protection.

Why Choose an LLC in Texas?

Liability Protection

Texas Limited Liability Companies provide extensive protection for the liability of their business members. A Texas LLC protects your personal assets, such as home property and savings, as well as your car, against business-related debts and legal actions.

No State Income Tax

Texas business owners enjoy a major advantage due to the state’s nonexistence of personal state income tax. Franchise taxes based on revenue are normally the only payments that LLCs in Texas need to make, as they are exempt from corporate taxes.

👉 Learn more about the Texas franchise tax

Tax Flexibility

Texas treats each LLC as a pass-through entity by default; thus, profits and losses from the business flow directly to its members, who must report them on their individual tax returns. Your Texas LLC can select taxation via C Corporation or S Corporation methods to receive specific tax advantages.

Operational Simplicity

Texas LLCs offer improved operational simplicity thanks to their optional annual meeting requirement and lack of record-maintenance protocols.

Credibility

A business achieves both professional status and legal standing by registering as an LLC, which provides credibility to clients and business partners. Your organization can use LLC status to develop customer trust, which will lead to sustained business credibility.

📌 For more details on LLC structures and legal requirements, visit the Texas Secretary of State – Business Filings Section.

2. Step‑by‑Step Guide to Forming Your Texas LLC

2.1 Choose a Unique Name for Your LLC

The process of register an LLC in Texas starts by choosing an accepted business name that stands apart from other registered entities. All Texas LLCs must have a distinct business name that establishes their legal standing through particular terminology.

How to Choose a Legally Compliant Name in Texas:

- Verify Name Availability

Verify if your business name is free by conducting a search through SOSDirect Business Entity Search. Your business name needs to stand apart from all other names which exist within the Texas Secretary of State database. - Follow Naming Guidelines

A business name must at least contain one of these elements:

- “Limited Liability Company”

- “Limited Company”

- Or an abbreviation like “LLC” or “L.L.C.”

Business names that lack official authorisation cannot contain terms such as “bank”, “trust”, or “insurance” or suggest government agency connections.

👉 See full naming rules under Texas Administrative Code §79.31

- “Limited Liability Company”

- Secure a Matching Domain Name

Before building a website, you should verify if your business name is available for use as a domain name. An online brand identity with consistency emerges from choosing this strategy.

Pro Tip: A business name generator provides free suggestions when you struggle to find names. You can generate innovative business name suggestions using free tools designed for this purpose.

2.2 Appoint a Registered Agent

Every newly formed Texas LLC needs to select a registered agent who handles official correspondence such as legal documents, tax notices, and government communications. Each LLC formed in Texas requires a Texas-based registered agent with no authorized use of P.O. Boxes and must be available during regular business hours.

Your selection of a registered agent needs attention to these factors:

- Dependability: When picking a registered agent, you should select someone dependable whose job is to handle all essential papers and forward duties quickly.

- Availability: Business hours availability is essential because the agent needs to receive deliveries at their designated office location.

- Legal Compliance: A Texas Secretary of State and active location requirement applies to agents for legal compliance in Texas Secretary of State operations.

A limited liability company cannot serve itself as a registered agent for its documents. Any chosen professional registered agent service must hold legal authorisation to provide services in Texas.

For more details, visit the Texas Secretary of State’s Registered Agent Guide.

2.3 File Certificate of Formation

File Certificate

A Certificate of Formation stands as the fundamental piece required to create your Texas LLC properly. The Texas Secretary of State requires your application together with payment of fees through online or postal submission.

Submit Your Business Information:

The filing needs to include four critical components: the LLC name, the names and addresses of the registered agent and manager, and the purpose of the business.

Complete Form 205:

The Texas Secretary of State demands that Texas LLCs submit their Form 205 – Certificate of Formation. The Certificate of Formation form requires completion through the SOSDirect portal submission or mailing to the Secretary of State.

Submit and Pay Fees:

The filing of the Certificate of Formation needs a payment of $300. Online submissions need credit card payments, whereas mailed forms must be accompanied by checks or money orders that are made to the Secretary of State.

2.4 Create an Operating Agreement

Operating Agreement

Texas state laws do not force LLCs to establish an operating agreement, but they strongly advise the creation of one. The internal document establishes how your LLC handles its ownership distribution between members and their responsibilities alongside operational and decision-making procedures.

Importance of an Operating Agreement:

- Establish Clear Business Guidelines:

The Operating Agreement creates a structure for LLC operations through its specifications about leadership roles while determining voting methods and profit distributions along with dispute resolution procedures. - Preserves Limited Liability Status:

Your LLC maintains a separate legal status because you have a written Operating Agreement. The distinct nature of business entities matters greatly because they defend member assets from business liabilities and legal actions. - Minimizes Internal Disputes:

Documenting the roles of members alongside decision‑making powers and methods to handle disagreements significantly reduces the likelihood of member disputes and misunderstandings.

2.5 Obtain an Employer Identification Number (EIN)

The Texas LLC needs to obtain an Employer Identification Number (EIN) through the IRS to operate. Your business needs this number to function like a Social Security Number for tax purposes, including employee recruitment and bank account openings, as well as tax processing at the federal and state levels.

The Internal Revenue Service provides EIN services for free through online applications or by mailing or faxing Form SS-4.

Apply for an EIN:

- Online application (recommended): Apply for EIN at IRS.gov

- Mail or fax Form SS‑4: Download Form SS‑4 (PDF)

2.6 File the Initial Statement of Information

Initial Statement

Texas entities do not need to file Initial Statements of Information, yet they require specific reporting for new Limited Liability Companies. Several obligatory submissions need to become effective and preserve your LLC’s good standing.

Required Filings:

- Annual Franchise Tax Report: Texas Comptroller demands that every Texas LLC submit its annual Franchise Tax Report. Your LLC requires this annual filing in order to preserve its good standing status.

- Public Information Report (PIR): Businesses filing Annual Franchise Tax Reports need to accompany this filing with a Public Information Report to disclose their LLC officer and manager data.

2.7 Register for State Taxes and Obtain Licenses

State Taxes

Your LLC requires different state tax registrations and particular licenses and permits based on its business operations.

- Sales Tax Permit: Your LLC requires a Sales Tax Permit from the Texas Comptroller of Public Accounts since you sell taxable goods or services.

- Franchise Tax: The Texas Franchise Tax applies to LLCs operating in Texas when their earned revenue reaches specified levels.

- Employment Taxes: An LLC that employs workers needs to enrol for employment tax obligations such as unemployment insurance alongside state tax withholdings. Register with the Texas Workforce Commission.

- Business Licenses and Permits: A business requires state, local, or federal permits according to its nature and area of operation. Texas operates without an overall business license, yet provides the Texas Business License & Permit Guide for companies to identify their required permits and licenses.

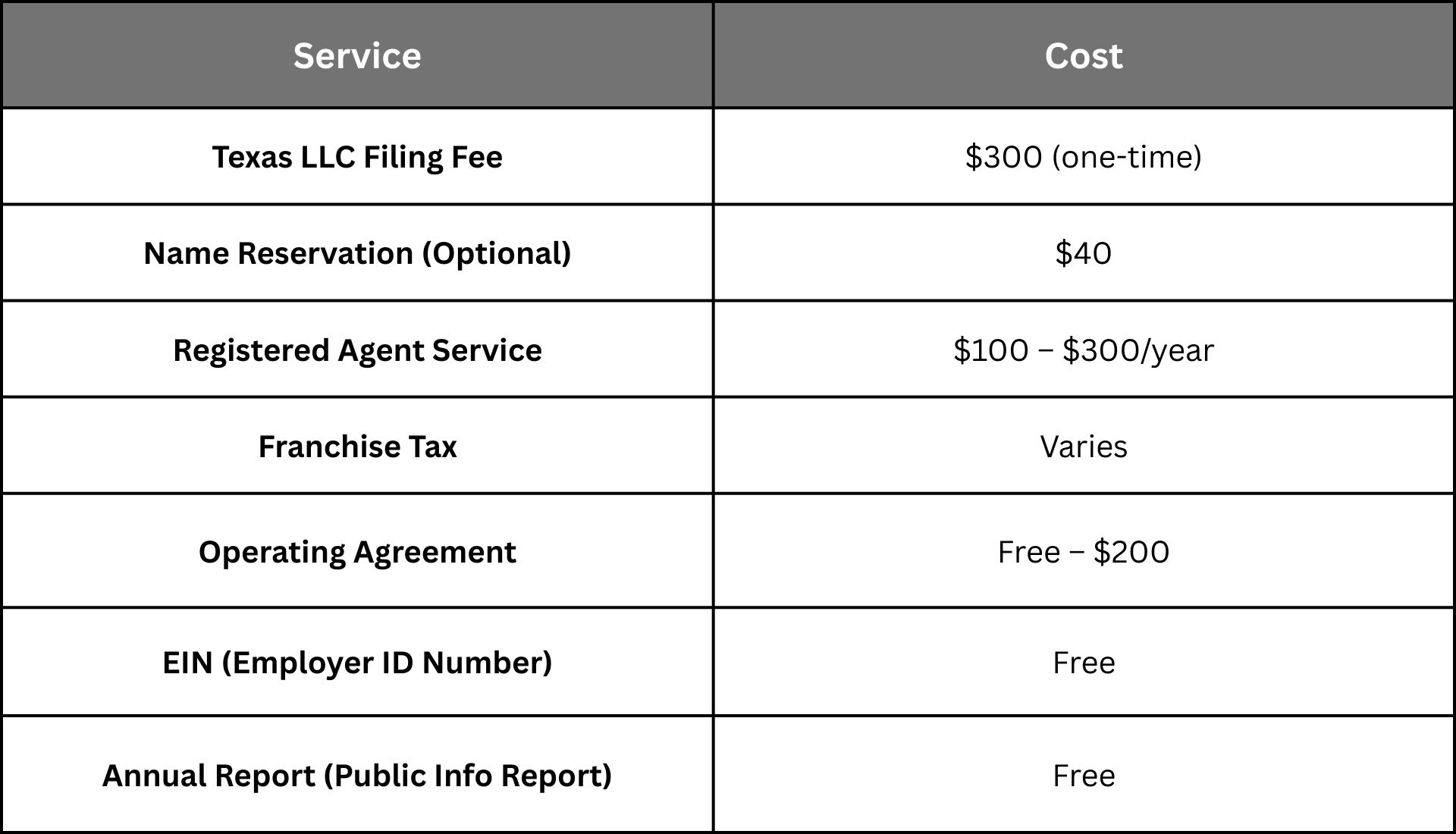

3. Costs & Tax Responsibilities of Starting an LLC in Texas

4. Ongoing Requirements for Your LLC

4.1 Annual Franchise Tax

Texas imposes an annual franchise tax obligation on all LLCS, which is calculated based on their revenue total. The tax amount relates to the earnings of each LLC. All TX-based LLCS whose annual revenue falls below $1.23 million (2025 amount) can achieve No Tax Due status, yet must still file their required annual report. The franchise tax payment becomes mandatory when your LLC produces revenues higher than the prescribed threshold.

4.2 Biennial Report

Texas requires all LLCS to submit a biennial report to the Texas Secretary of State containing updated details about company officers while maintaining the current address. The LLC requires submission of this report every two years to preserve its active status.

Why Starting an LLC in Texas Could Be a Game Changer

Access to a Growing Market

Texas maintains one of the biggest economic positions in the United States due to its successful business atmosphere. Texas has a multifaceted economy that consists of energy, technology, healthcare, and manufacturing sectors, thus creating a wide array of customers who can support business expansion. Startups find that Texas provides an ideal business environment that generates multiple expansion opportunities.

Liability Protection

Texas residents who form an LLC can shield their personal assets from potential business liabilities. The legal protection under Texas law shields business owners assets from any financial obligations related to business operations. Texas LLCS protect individual owner assets, including savings and real estate, from business-related creditor action.

Credibility

Businesses operate with superior credibility by establishing an LLC in Texas. The official LLC status creates a sense of authenticity that customers, together with investors and partners, recognize as valid. The business-friendly regulatory framework of Texas serves as an attractive quality for entities that want to build respected companies.

Is an LLC in Texas Right for You? Potential Drawbacks

The advantages of making an LLC in Texas come with certain drawbacks that business owners must think about:

- Franchise Tax: Texas has an annual franchise tax system which requires payment from every LLC operating within the state. Businesses with minimal revenue and small organisations might face challenges because the Texas annual filing, together with payment responsibilities, exceeds the basic tax rates of neighbouring states.

- Complex Business Regulations: Texas businesses operating under state or local authority must follow rules that change depending on business features and operational locations. While Texas maintains favourable business regulations, these rules present difficulty to businesses without experience in this area. Professional help will be necessary for your business to achieve complete compliance with every relevant requirement.

- Ongoing Compliance: A Texas LLC must file annual reports, constituting updated business information with the state, in order to maintain ongoing compliance. Incomplete, timely compliance requires penalties, which could potentially lead to the suspension of your LLC’s good standing status. Your LLC needs to fulfil continuous filing requirements to maintain its validity.

What to Do After You’ve Set Up Your LLC in Texas

After your LLC is established in Texas, you need to follow several crucial steps to maintain full business operation and legal compliance:

- Obtain an Employer Identification Number (EIN)

The IRS requires every LLC to obtain an EIN to enable proper tax handling, along with employee recruitment and business banking activities. You can apply for an EIN online for free. - Register for State Taxes

The tax obligations of your Texas LLC depend on its activities, since it might require state registration for sales tax or employment tax. All Texas businesses that conduct sales activity must obtain a sales tax permit through the Texas Comptroller of Public Accounts. - Obtain Necessary Permits and Licenses

Various business activities combined with geographic location determine the required permits and licenses your LLC needs for operation. Your business requires different permits, which might be local business licenses combined with health permits and industry-specific licenses. - Maintain Your LLC’s Good Standing

Your LLC needs to file necessary biennial reports and maintain franchise taxes and other state requirements to preserve good standing status. Your LLC will continue its state of good standing by maintaining accurate records and complying with all necessary filing deadlines.

Frequently Asked Questions (FAQS)

Do I need a lawyer to open an LLC in Texas?

The process of forming an LLC in Texas does not require a lawyer to complete it. Obtaining legal counsel for specific questions or complex issues will be beneficial, but consulting a lawyer is optional when forming an LLC in Texas.

How much does it cost to start an LLC in Texas?

- LLC Formation Fee: $300

- Franchise Tax: Based on revenue, with a minimum of $0 if your LLC qualifies for the No Tax Due status (revenue less than $1.23 million).

- Additional Costs: Permits, licenses, and optional professional fees.

How long does it take to form an LLC in Texas?

- Online Filings: Usually processed within 7–10 business days.

- Mail Filings: Can take several weeks. You can expedite processing by paying an additional fee for faster processing.

Are there ongoing requirements for an LLC in Texas?

Texas LLCS must perform a biennial filing process while paying their annual franchise tax obligations. Failure to meet these requirements may lead to both fines and the loss of good standing status.

What is an Operating Agreement, and is it required in Texas?

Every LLC needs an Operating Agreement to establish how the business functions internally. Texas does not enforce Operating Agreements on LLCS, yet law practitioners recommend these documents because they prevent conflicts and define member duties.

Do I have to file taxes for an LLC if it has no income?

No matter the absence of LLC income, you need to submit both the annual franchise tax report and the required No Tax Due status form. Lack of submission will lead to financial repercussions.

Can I form a single‑member LLC in Texas?

Texas covers the establishment of single-member LLCs. A Texas single-member LLC enables its owner to maintain shielded business status from personal liabilities.

Is forming an LLC in Texas worth it?

Texas business owners who establish LLCs receive business expertise alongside liability defences and tax regulatory options. The costs of maintaining compliance with rules and regulations, along with franchise tax obligations, become considerations for business owners when forming an LLC.

Do I need a lawyer to start an LLC in Texas?

Seeking legal consulting to form your LLC and follow state regulations can be helpful but is not necessary.

What are the ongoing requirements for maintaining an LLC in Texas?

Texas law requires LLCs to submit their biennial report together with annual franchise taxes to maintain an active status.

Key Takeaways

- Strong Liability Protection: A Texas LLC shields members’ personal assets, such as homes and savings, from business debts and legal actions.

- No State Income Tax on Individuals: The State of Texas does not assess personal income tax on residents, thus belonging to the nine states without such taxation.

- Annual Franchise Tax Requirement: Every Texas LLC needs to file its franchise tax report by May 15 annually, and the state charges privilege taxes when business revenue exceeds specified thresholds.

- Registered Agent Mandate: Texas requires every LLC to maintain a Texas-based registered agent and physical address continuously because failure to do so may cause the loss of business status.

- $300 Certificate of Formation Fee: Every Texas LLC needs to file Form 205 (Certificate of Formation) through the Texas Secretary of State and pay $300 for the creation of an official LLC.

- Operating Agreement Recommended: Having a formal Operating Agreement offers beneficial protection for your liability status but remains optional yet strongly recommended for your LLC framework.

- Free EIN from the IRS: The IRS provides free EINs, which you can acquire through their website, to support employee hiring while establishing bank accounts and filing federal taxes.

- Minimal Corporate Formalities: Texas LLCs maintain operational simplicity through their exemption from annual meeting requirements and mandatory formal record-keeping obligations.

- Ongoing Compliance Filings: The obligation to maintain good standing requires LLCs to file both their biannual Public Information Report and potentially their biennial updates.

- Tax Flexibility: The default IRS pass-through tax classification for LLCs allows owners to transform into S-Corporation or C-Corporation status through required federal tax filings for improved fiscal performance.