Do you plan to start your own business operations in Ohio?

Your upcoming business journey needs a smooth start which this guide provides to help you achieve it.

A new business entity through LLCs in Ohio provides suitable corporate benefits to independent workers while meeting the requirements of freelancers alongside busy entrepreneurs. The LLC business structure helps with the organization while protecting your personal assets and granting flexible ways to manage operations.

Ohio law makes the process of open an LLC feasible with several required steps to advance. The complete formation procedure for an Ohio LLC is covered in this guide which includes selecting an appropriate business name and filling official documents and maintaining state requirements.

This complete guide will direct you through starting an LLC in Ohio in 2025. We decompose difficult information into systematic breakdowns so you can start your business with success and we offer official documents and accurate pricing information from authentic sources.

Let’s get started!

Table of Contents

- Understanding LLCs in Ohio: Why It’s a Smart Choice

- Step-by-Step Guide to Forming Your Ohio LLC

- Pricing Information for Creating an LLC in Ohio

- Ongoing Requirements for Your LLC

- Who Can Start an LLC in Ohio?

- Why Starting an LLC in Ohio Could Be a Game Changer

- Is an LLC in Ohio Right for You? Potential Drawbacks

- What to Do After You’ve Set Up Your LLC in Ohio

- Frequently Asked Questions (FAQs)

- Conclusion: Ensuring Your LLC is Legally Protected

1. Understanding LLCs in Ohio: Why It’s a Smart Choice

A limited liability company functionally operates in terms of both corporation liability protection and a sole proprietorship or partnership taxation simplicity. Establishing an LLC in Ohio gives you the protection of personal assets along with business freedom from corporate operational procedures.

Why Choose an LLC in Ohio?

- Liability Protection: A business organised as an LLC protects your personal property from claims related to legal matters and business debt payments.

- Tax Flexibility: Businesses using LLC tax treatment operate through individual tax filings, so they avoid paying income tax at the business and individual levels.

- Operational Flexibility: LLCs maintain operational ease because they need fewer mandatory papers and fewer mandatory procedures than corporations.

- Credibility: Creating an LLC in Ohio creates improvements in business credibility that customers and investors alongside other stakeholders, can recognise.

2. Step-by-Step Guide to Forming Your Ohio LLC

2.1 Choose a Unique Name for Your LLC

To establish your Ohio LLC you must select a special business name which satisfies all regulations for LLC naming standards. A Limited Liability Company operating in Ohio must have its name distinguishable from all businesses registered in the state using the official term “Limited Liability Company” or abbreviated forms “LLC” or “L.L.C.”

Steps for Choosing Your LLC Name:

- Verify Name Availability: You should check the availability of your desired name through the Ohio Secretary of State’s business name search tool. Verify Name Availability

- Adhere to Ohio’s Naming Standards: Your business name should not contain words that imply public institutions or regulated industries such as the FBI government or Bank.

- Check Domain Availability: Before registration secure an online domain that corresponds with your LLC name to use for your website and email access.

Helpful Hint: A business name generator is a useful tool for generating inspirational names when it is challenging to come up with a unique, suitable name.

2.2 Appoint a Registered Agent

All Ohio LLCs must select a registered agent who will capture official business documents that originate from governmental bodies. An agent responsible for LLC document delivery must maintain an Ohio-based dwelling and operate during standard business hours.

Choosing a Registered Agent:

- Businesses can establish their registered agent position through trusted personnel or appointed professional services.

- The registered agent must meet state regulations so they can properly receive official documents sent to the company.

2.3 File Articles of Organization

A legal Ohio LLC requires a submission of Articles of Organization to be filed with the Ohio Secretary of State. The Ohio Secretary of State allows you to file Articles of Organization both online and through the mail system.

Filing Process:

- Submit Your Information: Starting your LLC in Ohio requires input of basic information, including your business name and location, alongside your designated agent and member versus manager management structure.

- Complete the Form: The Ohio Secretary of State enables submission through its website for Articles of Organization, but also offers the form for print and mail submission. Complete the Form

- Pay the Filing Fee: The cost needed to file Articles of Organization in Ohio with the Secretary of State amounts to $99.

2.4 Create an Operating Agreement

The state of Ohio does not require Operating Agreements for LLCs yet establishes strong recommendations for their use. An Operating Agreement lays out the LLC organization as well as member responsibilities and business operational details.

Why You Need an Operating Agreement:

- Clarity: The clearness of this document safeguards members from misunderstandings by creating specific guidelines.

- Preserves Liability Protection: Through this provision, your business maintains its separate identity thus safeguarding members against personal liability risks.

2.5 Obtain an Employer Identification Number (EIN)

The Employer Identification Number (EIN) becomes necessary when an LLC maintains personnel sets up a business bank account seeks business licenses or prepares tax filings. Your enterprise requires an EIN for tax reasons and IRS identification purposes. You can procure an EIN cost-free at the IRS website. The online EIN application requires minimal effort to execute, thus you will gain your number instantly upon finishing the process. Obtaining an EIN provides value to your business despite not offering employment because it creates a clean professional divide between personal funds and business assets. An EIN is essential for LLCs seeking corporate tax treatment since that form of taxation requires an EIN to be in place. Obtaining an EIN serves as an important procedure to maintain your LLC’s formal organizational structure. EIN is free and online.

2.6 File the Initial Statement of Information

Ohio does not demand businesses to file an Initial Statement of Information because the state does not follow this requirement like numerous other states. The upkeep of your LLC’s state compliance requires you to submit biennial reports even though the initial Statement of Information is not mandatory in Ohio. All Ohio business owners who form LLCs must file biennial reports even though an initial statement is not required to confirm current business information such as agent registration details and operating address. Your LLC needs this filing as a requirement to retain good standing with the state and to prevent fines. Your LLC may still be required to meet essential local or state-specific licensing together with tax reporting requirements even though Ohio lacks an initial statement requirement.

2.7 Register for State Taxes and Obtain Licenses

Business activities determine whether you must sign up for state taxes that include sales tax and employee withholdings. Ohio mandates the acquisition of particular licenses or permits which are required for legal business operations. Register for State Taxes

State Tax Registration:

- Sales Tax: Your LLC requires a sales tax permit from the Ohio Department of Taxation when it sells taxable products or services.

- Employer Taxes: A company with staff members must connect with the Ohio Department of Job and Family Services (ODJFS) for unemployment insurance and employee tax withholding requirements. State Tax Registration

Business Licenses and Permits: You must verify the required licenses and permits by contacting your local city or county government to operate your business activities legally.

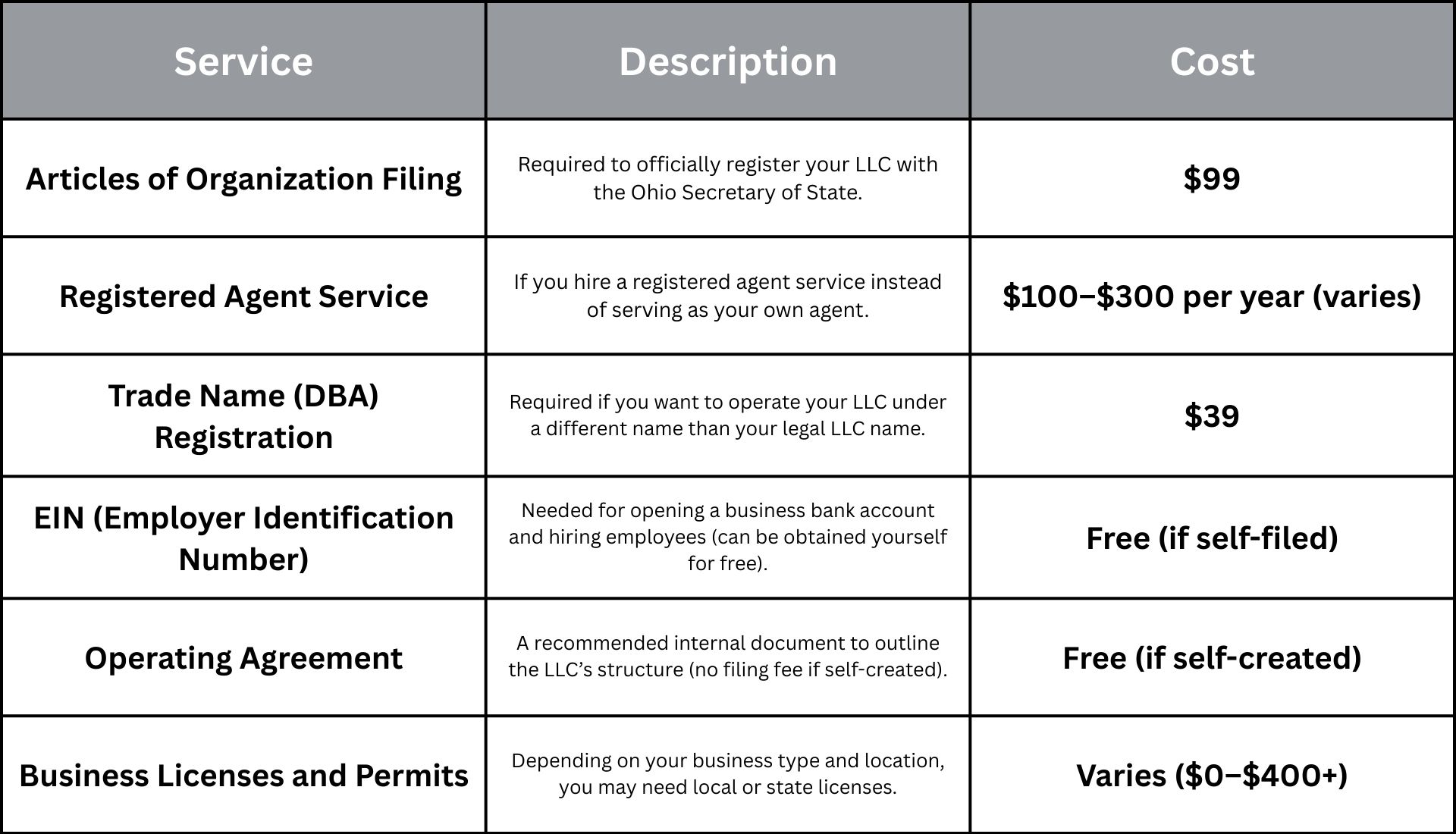

3. Pricing Information for Creating an LLC in Ohio

4. Ongoing Requirements for Your LLC

4.1 Annual Franchise Tax

The state of Ohio exempts LLCs from franchise taxes thus your business will escape potential tax obligations that affect companies operating in other states. To maintain active business status through article renewal you need to pay a $99 annual fee for filing the Article of Organization. The yearly $99 payment serves to keep your LLC active by maintaining your business compliance with Ohio’s filing regulations. Stuff users need to stay alert to this renewal payment yearly to prevent setbacks during the renewal process. The Ohio tax system remains straightforward, yet you must identify any additional taxes which affect your LLC, depending on its industry type or location.

4.2 Biennial Statement of Information

Ohio LLC operators must submit the biennial report called Statement of Information to preserve their good standing. Every Ohio LLC needs to submit the biennial report because it maintains business participation in the state records and protects accurate business information, including registered agent and business address details. Payment for the biennial report fee occurs when an LLC submits the Articles of Organization for $99. Doing your biennial report will protect your LLC from dissolution and penalties from the state government. Your company may become inactive if you cannot file your reports on time because the state could impose further difficulties, so maintain awareness of filing requirements. Biennial Statement

5. Who Can Start an LLC in Ohio?

Individuals who reach eighteen years of age can establish an LLC in Ohio if they meet the standard obligations for business operations according to state law. The state of Ohio neither prohibits nor restricts foreign individuals from forming an LLC for business operations. Both domestic business owners from outside Ohio and foreign business operators find Ohio appealing to launch U.S.-based companies. The basic eligibility requirements for forming an LLC in Ohio do not restrict any potential business owner, including U.S. and non-U.S. residents. An LLC requires a registered agent with an Ohio-based address for document delivery and state communication.

6. Why Starting an LLC in Ohio Could Be a Game Changer

- Access to a Thriving Economy: The wide range of industries, from manufacturing to healthcare and finance, positions Ohio as an excellent place to start a business.

- Business-Friendly Environment: The business environment in Ohio presents itself as favourable since it maintains both lower expenses and simplified administrative rules than most other states.

- Liability Protection: An LLC provides its members with robust liability protection because their personal assets stay protected when the company has legal problems or debts.

7. Is an LLC in Ohio Right for You? Potential Drawbacks

A business owner should weigh both positive benefits and potential negative aspects when deciding to establish an LLC in the state of Ohio. These are the main weaknesses individuals need to understand regarding choosing an LLC in Ohio:

1. Fees and Taxes

Business owners initiating operations in Ohio should pay attention to specific fees that the state imposes despite its business-friendly tax structure. Ohio operating LLCs must file their Articles of Organisation, which includes payment of a $99 annual fee, while those businesses located in particular areas must also meet local tax obligations. Ohio LLCs must file their taxes by paying the Commercial Activity Tax (CAT) whenever their annual gross receipts reach more than $150,000. Minimal revenue, together with limited funds, makes these fees and taxes potentially challenging for small LLCs operating in the state.

2. Regulatory Requirements

Ohio implements straightforward business regulations, although companies have to meet all necessary state laws and government requirements. The legal operation of your business in Ohio depends on acquiring the necessary licenses in addition to any required permits that match your business activities. The overall process, including time and budget expenditures to establish your LLC may become longer because of these requirements. The regulations that guide Ohio businesses, together with industry-specific requirements, prove complex for many companies, thus requiring help from legal professionals.

3. Ongoing Compliance

LLCs operating in Ohio must submit biennial reports to protect their status of good standing, even though the state does not require extensive regular filings. The Articles of Organisation fee contains the filing charge for this report, so neglecting the required filings can lead to LLC dissolution and penalties. Ohio LLCs need to keep proper documentation, such as tax reports, while regularly checking for state and local compliance needs to prevent legal problems. The Ohio Secretary of State’s office presents documentation for retaining your LLC status through proper reporting procedures.

8. What to Do After You’ve Set Up Your LLC in Ohio

Operating your Ohio LLC demands certain specific steps to establish your business with full compliance. Here’s what you need to do:

1. Obtain an Employer Identification Number (EIN)

A business must obtain an EIN for taxation requirements and create a business bank account. The IRS provides free EIN applications through its website, where you can execute the application process without difficulty. Every commercial entity requiring an employer identification number must develop a formal financial system or have personnel on staff.

2. Register for State Taxes

Every business operating in Ohio must enrol in applicable state taxes based on its business scope. When operating with tangible goods for sale, businesses must enrol to collect sales tax. Business owners who hire employees need to conduct state employment tax registration. The Commercial Activity Tax (CAT) affects business operations when their yearly gross receipts surpass $150,000. Contact the Ohio Department of Taxation to register for required taxes while accessing their resources that guide tax registration.

3. Obtain Necessary Permits and Licenses

Your business may require certain permits and licenses, which are mandatory for legal operation in Ohio, according to its particular nature. A specific state business license is absent in Ohio, but certain establishments must follow health, safety and environmental rules through relevant permits depending on their sector. Businesses operating in Ohio must consult their local government officials because these authorities enforce independent license and registration obligations that determine complete compliance. The Ohio Business Gateway contains an organised list showing what licenses businesses need in specific industries.

4. Maintain Your LLC’s Good Standing

The Ohio Secretary of State demands that all LLCs maintain good standing status through the submission of biennial reports. Your business stays active while meeting state requirements through required biennial reporting to the state secretary. Maintaining accurate records and performing proper tax obligations are essential responsibilities of all LLCs in the state. LLCs must also pay their fees and taxes on time. Not filing mandatory reports together with insufficient tax compliance will result in penalties and potentially lead to the dissolution of your LLC. To keep your LLC in good standing, consult additional information at the Ohio Secretary of State’s website.

9. Frequently Asked Questions (FAQS)

1. Do I need a lawyer to open an LLC in Ohio?

Forming an LLC in Ohio is a do-it-yourself process, or so to speak, it does not require lawyers. The entrepreneurs can easily submit the required documents to the Ohio Secretary of State to form the LLC with them. But if you have complicated legal inquiries or business-specific requirements, it is sensible to seek the assistance of a legal practitioner for consultation.

2. How much does it cost to start an LLC in Ohio?

The cost to form an LLC in Ohio is as follows:

- Articles of Organization Filing Fee: $99

- Biennial Statement of Information Filing Fee: Included in the Articles of Organization filing fee, but required every two years.

- Excess charges can be added if you participate in a registered agent service or obtain any business licenses or permits.

- Optional expenses are, for illustration, the amount for consulting a professional to be able to deal with compliance or legal issues.

3. How long does it take to form an LLC in Ohio?

Here is the explanation of the Ohio LLC formation processing time:

Online Filings: Usually processed within 3-7 business days.

Mail Filings: Time may take 10-15 business days, depending on mail volume. By filling in an online form, you can speed up the process. If it is ever available, select the expedited option.

4. Are there ongoing requirements for starting an LLC in Ohio?

To keep good standing in Ohio, your LLC must:

Biennial Statement of Information: You will need to submit annual and biennial reports to keep your LLC active. There is no additional filing fee for this, as it is included in the initial Articles of Organisation fee.

Current Tax Compliance: File all tax returns, including Commercial Activity Tax (CAT) if applicable and pay all necessary fees. Noncompliance can incur fines and possibly result in the disbandment of your LLC.

5. What is an Operating Agreement, and is it required in Ohio?

An Operating Agreement is like a contract that explains how your LLC is run, owned and managed. Ohio does not require LLCs to have an Operating Agreement in law, but it is advised. Having one gives clarity and prevents conflicts by defining clearly how LLC is operated and by how many owners are shared members.

6. Do I have to file taxes for an LLC if it has no income?

Yes, even if your LLC in Ohio has no income reported, you have to file an annual tax return, not least the Commercial Activity Tax (CAT) for gross receipts over $150,000. In addition, do not forget that you will still have to pay the minimum fees and segregated franchise tax when the LLC is not making profits. Not complying with these tax filings could lead to penalties or the closure of your LLC.

7. Can I form a single-member LLC in Ohio?

Yes, in Ohio, a single-member LLC may be formed. The same liability protection as multi-member LLCs is enjoyed by a single-member LLC, protecting the personal assets from business-derived liabilities.

8. Is forming an LLC in Ohio worth it?

Creating an Ohio LLC can be a good idea in order to limit liability, and increase the credibility of the business and in the matter of tax, you could be flexible. It is necessary to consider the weight of the permanent record and tax obligation against the benefits, especially the biennial filing mandate and the state tax. Ohio is a relatively simple and low-cost state in which to form an LLC compared to other states.

9. Do I need a lawyer to start an LLC in Ohio?

Although it is not necessary to hire an attorney to start an LLC in Ohio, doing so could prove helpful if you need legal compliance help with something such as liability, taxes, or the Operating Agreement. For most small business people, obtaining an LLC is doable by obtaining the materials from the Ohio Secretary of State’s office.

10. What are the ongoing requirements for maintaining an LLC in Ohio?

In order for your LLC to remain in good standing with Ohio, you are required to submit the biennial Statement of Information and be up to date on all of your taxes. The state does not have a fee for the biennial report, but neglecting to submit the report or follow tax laws may entail a penalty, a rate of interest on what is owed and can possibly lead to termination of the business LLC. Regular compliance keeps your business active and in good standing.

10. Conclusion:

Starting an LLC in Ohio offers the advantages of corporate liability, tax flexibility, and easy operation. You should be able to create your LLC by following the process in this guide and confidently starting your business journey. Once you stay in compliance with State guidelines, you will be well on your way to business success in Ohio!