Are you thinking about launching your own business in California?

You’re taking a big step, and this guide is here to help you get through it.

Starting an LLC in California creates an ideal situation for small business owners, freelancers, and entrepreneurs. An LLC structure provides your business with the organisation while protecting your personal assets and enabling you to maintain adaptable management practices.

Forming an LLC under California’s laws is simple, though you must follow the necessary steps, including selecting an appropriate name, submitting paperwork, and maintaining state compliance requirements.

This guideline provides comprehensive guidance about How to start an LLC in California for the year 2025. This guide translates complex information into simple steps by providing authentic resources which explain costs and hold official documents for your business launch success.

Let’s walk through it together.

Table of Contents

- Understanding LLCs in California: Why It’s a Smart Move

- Step-by-Step Guide to Forming Your California LLC

- Pricing Information for Creating an LLC in California

- Ongoing Requirements for Your LLC

- Who Can Launch an LLC in California?

- Why Starting an LLC in California Could Be a Game Changer

- Is an LLC in California Right for You? Potential Drawbacks

- What to Do After You’ve Set Up Your LLC in California

- Frequently Asked Questions (FAQs)

- Conclusion: Ensuring Your LLC is Legally Protected

1. Understanding LLCs in California: Why It’s a Smart Move

The LLC (Limited Liability Company) combines the advantages of corporate liability protection with sole proprietorship and partnership tax flexibility and operational simplicity. California utilises LLCs as a preferred option for business owners (also called “members”) who want to protect their personal assets from their business liabilities.

Why Choose an LLC in California?

- Liability Protection: LLCs protect their members’ assets because business debts and lawsuits cannot affect personal property owned by members (like homes or cars).

- Tax Flexibility: LLCs operate as pass-through entities by nature, which distribute business income and losses to members’ personal tax returns to prevent double taxation. An LLC can choose to have its tax obligations managed through corporate rules.

- Operational Flexibility: Business management under an LLC remains simpler than that under a corporation since LLCS do not need extensive documentation from the board or shareholder meetings.

- Credibility: The establishment of an LLC gives your business a professional appearance to clients, customers, and investors who view it as a serious and legitimate operation.

For more information, visit the official California Secretary of State website.

2. Step-by-Step Guide to Forming Your California LLC

2.1 Choose a Unique Name for Your LLC

The process of creating an LLC in California requires choosing a brand-aligned name that meets all legal naming requirements. The first step requires confirming that your business name does not match any of the names currently listed in the California Secretary of State’s records. According to state law, you must add “LLC”, “L.L.C.”, or “Limited Liability Company” as your business name’s ending.

A business owner should follow these steps to select a distinctive name that follows legal requirements.

- Verify Name Availability: Utilize the California Secretary of State’s Business Search tool help you verify whether any other business operates under your selected name.

- Adhere to Naming Standards: Caution should be taken when using words that might imply support from governmental institutions, such as “Agency,” “Commission,” “Department,” “Bureau,” “Division,” “Municipal,” or “Board.”

- Plan Your Digital Footprint: When creating an online platform for your business, you must verify the availability of a matching domain name.

Helpful Hint: A business name generator is a useful tool for generating inspirational names when it is difficult to come up with a unique, suitable name.

2.2 Appoint a Registered Agent

Every LLC operating in California needs to appoint a registered agent who serves as the contact point for receiving legal documents concerning the business. The registered agent must maintain a California-based physical address (excluding P.O. Boxes) because this ensures appropriate delivery of official documents available during regular business hours.

Selecting a registered agent requires you to take these elements into account:

- Dependability: Select a trustworthy person capable of safeguarding sensitive materials before they transmit them to you quickly.

- Availability: The agent should maintain a personable presence at their business hours address to receive documents by direct delivery if needed.

- Legal Compliance: Ensure the agent meets California state requirements by practising at a local California address and maintaining a business-hour presence.

An LLC operating in California cannot provide registered agent services for itself. Pursuing a corporate registered agent requires both authorisation to perform business activities in California and an active Corporate Registered Agent application filed at the Secretary of State. California Secretary of State

For more detailed information, refer to the California Secretary of State’s guidelines on registered agents.

2.3 File Articles of Organization

The Articles of Organization are vital documents for establishing your LLC in the state of California. Submission of this document to the California Secretary of State requires online or mail service with payment of applicable charges.

Filing Process:

- Submit Your Business Information: Detailed information regarding your LLC must include its name, followed by registered agent information and management structure specifications.

- Complete Form LLC-1: Your California LLC requires you to submit Form LLC-1 and pay the fee to file Articles of Organization.

- Submit and Pay Fees: The final step is to pay the $70 filing fee. The California Secretary of State permits you to submit your filing and make the required payment through its online business portal.

2.4 Create an Operating Agreement

Creating an operating agreement for your Limited Liability Company (LLC) is an advantageous practice, although California law does not require it. An internal document defines the business ownership structure, members’ responsibilities, and operational procedures.

Importance of an Operating Agreement:

- Establish Clear Business Guidelines: Business operations run more smoothly through the establishment of operational rules that define conflict resolution procedures outlined in the agreement.

- Preserves Limited Liability Status: Documentation of your LLC status as a separate entity shields member personal assets through the establishment of Clear Business Guidelines. Business operations run more smoothly through the establishment of operational rules that limit liability protection benefits.

- Minimises Internal Disputes: The detailed definition of organisational rules decreases members’ contradictory interpretations, which minimises possible conflicts.

2.5 Obtain an Employer Identification Number (EIN)

Your LLC requires an Employer Identification Number (EIN) to serve as the equivalent of a Social Security number for business operations, including employment and financial and tax reporting. The IRS provides EIN registration at no cost by allowing users to register through their website or via mail submission.

You need to investigate both franchise tax and sales tax requirements unique to your state since they affect LLC taxation. Companies owned by California LLC operators must pay the 15.3% self-employment tax divided into 12.4% Social Security and 2.9% Medicare parts. For more information, visit the California Franchise Tax Board’s website

2.6 File the Initial Statement of Information

The Initial Statement of Information (Form LLC-12) serving the California Secretary of State must be submitted by any newly formed LLC within its initial 90-day period. The form contains vital details about your LLC, which demands information on members and managers.

- Filing Fee: $20

- Where to File: You can file online through the California Secretary of State’s bizfile portal.

Timely submission of this form protects your LLC from penalties and ensures its good standing status.

2.7 Register for State Taxes and Obtain Licenses

Depending on your business activities, you may need to register for various state taxes and acquire specific licenses or permits:

- Seller’s Permit: An LLC that plans to sell or lease any tangible personal property taxable for sales tax needs to acquire a seller’s permit from the California Department of Tax and Fee Administration (CDTFA). Either wholesalers or retailers must obtain this permit for their operations.

- Employment Taxes: Firms planning to onboard staff need to register with the Employment Development Department (EDD), starting from the first day, when they pay more than $100 in wages to employees within a fiscal quarter. The Employment Development Department offers e-Services for Business, through which you can control your payroll tax account from an online platform.

- Business Licenses and Permits: The regulated permits depend on factors like business category and geographic location. The CalGold website can help you identify the exact permits and licenses that apply to your enterprise. This resource matches your business activities with official guidelines regarding local regulations.

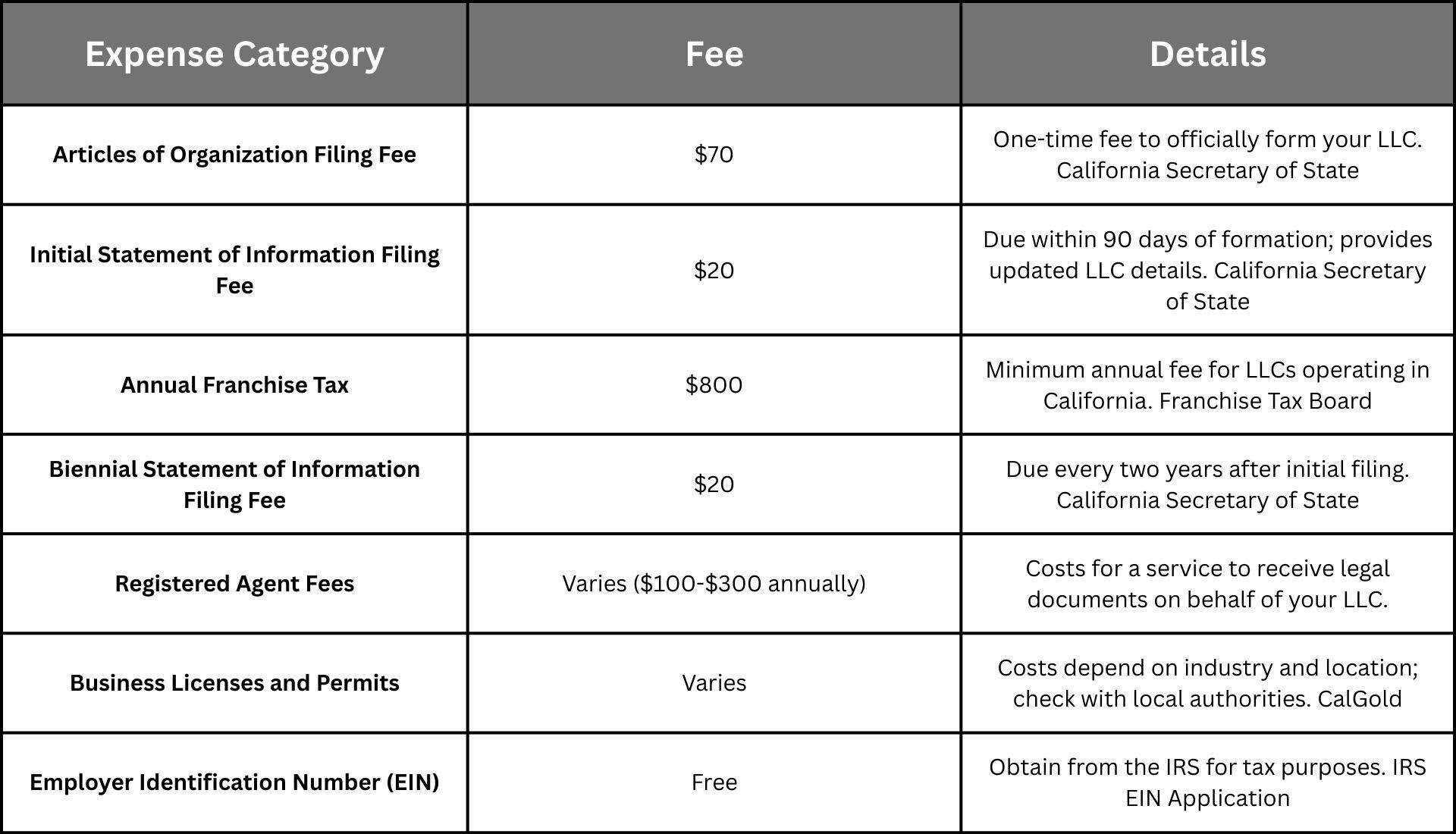

3. Pricing Information for Creating an LLC in California

4. Ongoing Requirements for Your LLC

4.1 Annual Franchise Tax

California requires every LLC registered in the state to pay an annual franchise tax regardless of its business activities. The minimum fee is $800 yearly.

4.2 Biennial Statement of Information

An LLC submits Biennial Statement of Information (Form LLC-12) to the state twice during every two-year cycle in order to provide updated member, manager, and other essential information.

Why Starting an LLC in California Could Be a Game Changer

The advantages of forming an LLC in California establish it as a significant entrepreneurial opportunity. Some of the key reasons are:

1. Access to a Large Market

California is America’s biggest state economic power and presents businesses with ideal conditions. California houses many different industries, including technology, entertainment, agriculture, and tourism, which create an extensive customer market for business operations. The business market in California offers its entrepreneurs market diversity and abundant growth prospects for their companies. The California Business Portal contains additional data about business conditions in the state.

2. Liability Protection

An LLC safeguards personal property from business risks because it creates legal protection against business debts and liabilities. Personal financial loss stays protected by starting an LLC in California because it provides a shield for business owners from organisational responsibilities. To learn more about how LLCs protect founders from liability, visit the U.S. Small Business Administration (SBA) web pages.

3. Credibility

A business operating as an will enhance your company’s credibility. A business with an LLC set up in California can demonstrate legitimacy since California maintains a strong regulatory atmosphere for investors and suppliers. Businesses that work in trust-based industries find particular value in establishing operations in California. Visit theOpen LLC in California California Secretary of State’s website for complete information about building a trustworthy business in California.

Is an LLC in California Right for You? Potential Drawbacks

The formation of California LLCs provides many advantages, but business owners must evaluate several possible negative aspects.

1. High Fees and Taxes

The state of California levies among the most expensive business taxes throughout the United States. Businesses registered under LLC must pay an $800 franchise tax to the state every year, irrespective of their financial performance. Total income levels determine whether LLCs must pay beyond the standard fees of this entity type in California. The California Franchise Tax Board maintains valuable resources on the state’s business taxation system.

2. Complex Regulations

California maintains a difficult regulatory environment because it imposes extensive rules and compliance obligations. Your business may require compliance with different legal obligations, which range from environmental regulations to employment laws, according to their nature. Usually, unknown state laws require professional legal assistance to guarantee that your LLC follows all necessary regulations. Additional details regarding compliance standards and business legislation exist at California Department of Industrial Relations.

3. Ongoing Compliance

California LLCs must perform biennial statements of information as part of their requirements, but this creates additional paperwork challenges for administrators. The late submission of required documents leads to penalties, which might lead to the permanent closure of your LLC. LLCs that operate in California must strictly follow mandatory reporting and compliance standards. California Secretary of State presents details about current compliance obligations on their official website.

What to Do After You’ve Set Up Your LLC in California

The formation of your California LLC calls for specific steps to make your business both compliant and operational:

1. Obtain an Employer Identification Number (EIN)

A business must have an EIN to handle taxes and establish a business banking account. The IRS provides EIN applications to obtain free of charge. The IRS website allows users to complete their application process in a simple manner.

2. Register for State Taxes

Each business activity decides whether to register for various state taxes, such as sales and employment taxes and additional state-specific taxes. To register for these taxes, you need to contact the California Department of Tax and Fee Administration (CDTFA). Product sales and employee recruitment require particular attention during this essential process.

3. Obtain Necessary Permits and Licenses

Every business within California needs the proper combination of licenses and permits to match their commercial field. To operate legally, your business will need both a seller’s permit and health and zoning permits. All businesses must meet every regulation at local, state, and federal levels. Companies can access licensing requirements by checking the California Business Portal.

4. Maintain Your LLC’s Good Standing

Your LLC remains active in good standing by filing a biennial Statement of Information and by keeping accurate records. Your business must meet all current tax requirements and file necessary reports for compliance purposes. Additional details about this subject can be found on the California Secretary of State’s website.

5. Frequently Asked Questions (FAQs)

1. Do I need a lawyer to open an LLC in California?

The formation process of a California LLC does not require you to hire a lawyer according to state regulations. Entrepreneurs successfully file documents with the California Secretary of State to independently establish their LLCs. If you have particular legal queries or business-specific needs in your LLC formation process, consulting with a legal professional should be considered.

2. How much does it cost to start an LLC in California?

Starting an LLC in California requires payment of diverse costs throughout the process:

- Articles of Organization Filing Fee: $70

- Initial Statement of Information Filing Fee: $20

- Annual Franchise Tax: $800 minimum, due annually. Business owners must pay fees to obtain a registered agent service, local business licenses and necessary permits, and the optional services of legal or professional experts.

3. How long does it take to form an LLC in California?

The processing time for an LLC formation in California varies:

- Online Filings: Typically processed within 3-5 business days.

- Mail Filings: This may take several weeks.

Paying an extra fee enables you to submit your application directly at the Secretary of State’s Sacramento office for faster processing times.

4. Are there ongoing requirements for starting an LLC in California?

Obtaining and sustaining your LLC’s good standing requires:

- Annual Franchise Tax: Pay the $800 minimum fee each year. Franchise Tax Board

- Biennial Statement of Information: File Form LLC-12 every two years, with a $20 filing fee.

Noncompliance with these obligations might lead to financial penalties together with possible termination of your LLC’s operating permission.

5. What is an Operating Agreement, and is it required in California?

Your LLC needs an Operating Agreement that defines both ownership structure and organizational form as well as operational protocol. The law of California does not require an Operating Agreement for LLCs, but such documents provide the advantage of achieving clarity about member responsibilities. The internal document allows members to avoid disagreements while enabling better organisational management.

6. Do I have to file taxes for an LLC if it has no income?

In California, all Limited Liability Companies need to file Form 568 annually and pay a minimum franchise tax of $800 without requiring any income. Noncompliance with these obligations might lead to financial penalties together with possible termination of your LLC’s operating permission.

7. Can I form a single-member LLC in California?

The state of California enables single-member LLC formation because it protects owners from liability risks.

8. Is forming an LLC in California worth it?

US business owners can form an LLC in California to get liability protection and tax flexibility, but they need to consider the expenses and state regulations.

9. Do I need a lawyer to start an LLC in California?

Legal advice is beneficial for LLC formation processes, although it is not mandatory for meeting state regulations.

10. What are the ongoing requirements for maintaining an LLC in California?

LLCs must file Statements of Information twice in two years and pay annual franchise tax fees to maintain good standing.

6. Conclusion: Ensuring Your LLC is Legally Protected

Establishing an LLC in California helps business owners protect their personal financial assets while simultaneously increasing their business credibility. Your compliance with state laws and adherence to this guide’s steps will position your LLC for achievement.

Access complete filing procedures alongside official materials on the California Secretary of State and Franchise Tax Board websites.