Dreaming of being your own boss in Indiana?

The process of establishing your own business in Indiana requires your consideration.

The decision to start an Indiana-based business is beneficial, and our guide will guide you through the necessary tasks step by step.

Indianapolis represents an excellent business choice for freelancers, entrepreneurs, and small business owners because it provides both organisational flexibility and personal asset protection. The LLC structure allows you to maintain business order, claim tax benefits, and retain full control over your operations.

Starting an LLC in Indiana is straightforward. However, it requires completing specific business name selection requirements, document submission, and state compliance.

This guideline applies to 2025 and helps you understand the process open an LLC in Indiana. It simplifies the steps required to explain costs while directing you to official business resources that support a strong launch.

Let’s get started!

Table of Contents

- Understanding LLCs in Indiana: Why It’s a Smart Move

- Step-by-Step Guide to Forming Your Indiana LLC

- Pricing Information for Creating an LLC in Indiana

- Ongoing Requirements for Your LLC

- Who Can Launch an LLC in Indiana?

- Why Starting an LLC in Indiana Could Be a Game Changer

- Is an LLC in Indiana Right for You? Potential Drawbacks

- What to Do After You’ve Set Up Your LLC in Indiana

- Frequently Asked Questions (FAQS)

- Conclusion: Ensuring Your LLC is Legally Protected

1. Understanding LLCS in Indiana: Why It’s a Smart Move

Understanding LLCs

The Limited Liability Company (LLC) combines corporate legal protection features with sole proprietorship and partnership tax savings together with organizational flexibility. Business operators in Indiana frequently select the Limited Liability Company structure to protect personal assets from business liabilities, thus maintaining operational simplicity.

Why Choose an LLC in Indiana?

- Liability Protection:

LLCs shield members’ personal assets from business-related debts and legal obligations. Business financial difficulties will not put your home savings accounts or car at risk since these assets remain protected.

- Tax Flexibility:

All Indiana LLCs operate automatically as pass-through entities. An LLC in Indiana permits members to receive direct tax treatment of their business income on their individual income tax reports instead of facing corporate taxation or double taxation. You possess the option to switch taxation systems to corporations if that enhances your business requirements.

- Operational Flexibility:

Indiana LLCs grant their members operational flexibility through exceptions to mandatory board meetings and complex recordkeeping procedure requirements. The business operations become more streamlined and time-efficient when you establish an LLC.

- Credibility:

Company formation as an LLC brings about a professional appearance which helps establish your business authority. Forming a legally established business structure sends a professional notice to your clients along with your investors and your customers.

For more details and official forms, visit the Indiana Secretary of State website.

2. Step-by-Step Guide to Forming Your Indiana LLC

2.1 Choose a Unique Name for Your LLC in Indiana

Establishing your LLC requires the creation of its distinctive name as your first business step in Indiana. Your business name should exhibit your brand alongside the legal requirements from Indiana Secretary of State – Business Services Division.

Guidelines for Naming Your Indiana LLC

- Check Name Availability

You must find a distinctive business name which does not already exist as an Indiana business entity. The Indiana Secretary of State’s Business Name Search enables you to determine whether a name is available for use.

- Follow Indiana Naming Rules

Your Limited Liability Company requires usage of Limited Liability Company or L.L.C. and LLC.

Acceptable formats include:

- Limited Liability Company

- L.L.C.

- LLC

Your business name selection must exclude any wording that gives false impressions or portrays association with government entities unless official permission exists. The complete list of naming limitations exists as per the guidelines provided by the Indiana Secretary of State.

- Reserve a Name (Optional)

Before forming your LLC you can reserve your business name through a Name Reservation form available at the Indiana Business Services portal for up to 120 days.

- Check Domain Availability

Before starting an online brand launch, check whether a matching domain name is available for your business. Having a single domain will improve your online presence. Domain searches can be performed throughthe tools provided by GoDaddy and Namecheap platforms. A business name generator available online will generate ideas for those who need inspiration for their business name.

2.2 Appoint a Registered Agent in Indiana

Every Indiana LLC must arrange for Registered Agent services. The business SERVICES division of this state registry appoints you as a contact person to receive documents.

Every LLC operating in Indiana must designate a person or service known as its Registered Agent, the Indiana Secretary of State – Business Services Division.

Choosing a Registered Agent in Indiana

An agent for your LLC should provide their physical Indiana address and fulfil their duties throughout regular business hours (9 AM to 5 PM).

Key factors to consider:

• Reliability – For reliable service, select either a known individual or a registered agent professional.

• Compliance – Your registered agent needs to follow these conditions, which are normally required by state law:

- Only Indiana residents or authorised businesses can handle this role.

- You need an Indiana location as your permanent address instead of using a post office box.

- Submit permission documents to represent your company as a registered agent officially.

You need to attach a Registered Agent Acceptance form to your Articles of Organisation before submission. You can choose to serve as your own registered agent, yet you need to fulfil every condition on the list. An LLC cannot accept this role.

2.3 File Articles of Organisation in Indiana

When you submit the Articles of Organisation your LLC becomes an official entity in Indiana. The business owner sends the document to INBiz – Indiana’s Official Business Portal for official approval.

Filing Process for Indiana LLCS

- Gather Required Information

The state requires business owners to provide their LLC name plus business address while also naming their registered agent and choosing between member-managed or manager-managed operations.

- Complete and Submit the Form

Through the INBiz portal, you can submit your application online while Form 49459 lets you create a paper filing. Pick the approach that helps you most easily establish your company. - Pay the Filing Fee

• Online: $95

• Mail: $100

•Address checks to the Indiana Secretary of State when submitting this document.

Mailing Address:

Business Services Division

302 W. Washington Street, Room E018

Indianapolis, IN 46204

2.4 Create an Operating Agreement in Indiana

Indiana state law lets you operate an LLC without an Operating Agreement yet strongly advises doing this document for best results. This document describes how your company is owned and how it operates.

Why Operating Agreements Matter in Indiana

- Defines Structure and Governance

The agreement sets out how members and managers handle their duties plus voting rights and business tasks.

- Maintains Limited Liability

It keeps your personal money protected since the document shows where business work happens. - Avoids Internal Disputes

Happy employees emerge from knowing what decision methods apply and what happens to positions upon departure. - Required by Banks and Legal Transactions

When you start bank relationships or sign legal papers most bank and legal professionals request to review your Operating Agreement.

Key Components of an Operating Agreement

- LLC name and primary address

• Member/manager names and responsibilities

• Ownership percentages and capital contributions

• Profit/loss distribution

• Voting and decision-making rules

• Member admission and withdrawal procedures

• Dissolution terms

2.5 Obtain an Employer Identification Number (EIN)

An LLC must obtain its EIN to manage business taxes and employer hiring while setting up company banking accounts. Your business needs an EIN to perform tax reporting and hiring activities just as a Social Security number represents an individual.

You can obtained an EIN free of charge through the Internal Revenue Service (IRS). Use the online application method to receive service quickly or send Form SS-4 through postal mail to the IRS.

Review all business tax and licensing regulations that apply only to companies operating in Indiana. Your LLC must sign up with the Indiana Department of Revenue (DOR) when you want to sell products that bring tax obligations. Both employers must sign up for tax obligation programs with their organisations.

2.6 Publication Requirements in Indiana

Uniformly across states, Indiana does not enforce newspaper announcements for LLC formation. Both the articles of organisation and the newspaper advertisements are unnecessary here.

The Secretary of State displays your Articles of Organisation and allows anyone to view them through the INBiz search portal. The business information meets the requirements of Indiana’s online reporting system INBiz – Indiana’s Official Business Portal.

2.7 Register for State Taxes and Business Licenses

Your LLC needs to follow tax and licensing rules from both the state and local government plus pay sales tax for goods or services sold.

Sales Tax (Registered Retail Merchant Certificate)

A Registered Retail Merchant Certificate from the Indiana Department of Revenue INBiz – Indiana’s Official Business Portal is mandatory for your LLC when it conducts sales of taxable goods or services.

Employment Taxes

When you employ staff your LLC must enroll in withholding tax reporting and unemployment insurance tax payment programs with Indiana Department of Workforce Development.

Business Licenses and Local Permits

The state of Indiana does not need a business license for companies but some municipal bodies could make them mandatory. Check what permits you need through INBiz Business Services or contact your local clerk’s office considering your business activities and location.

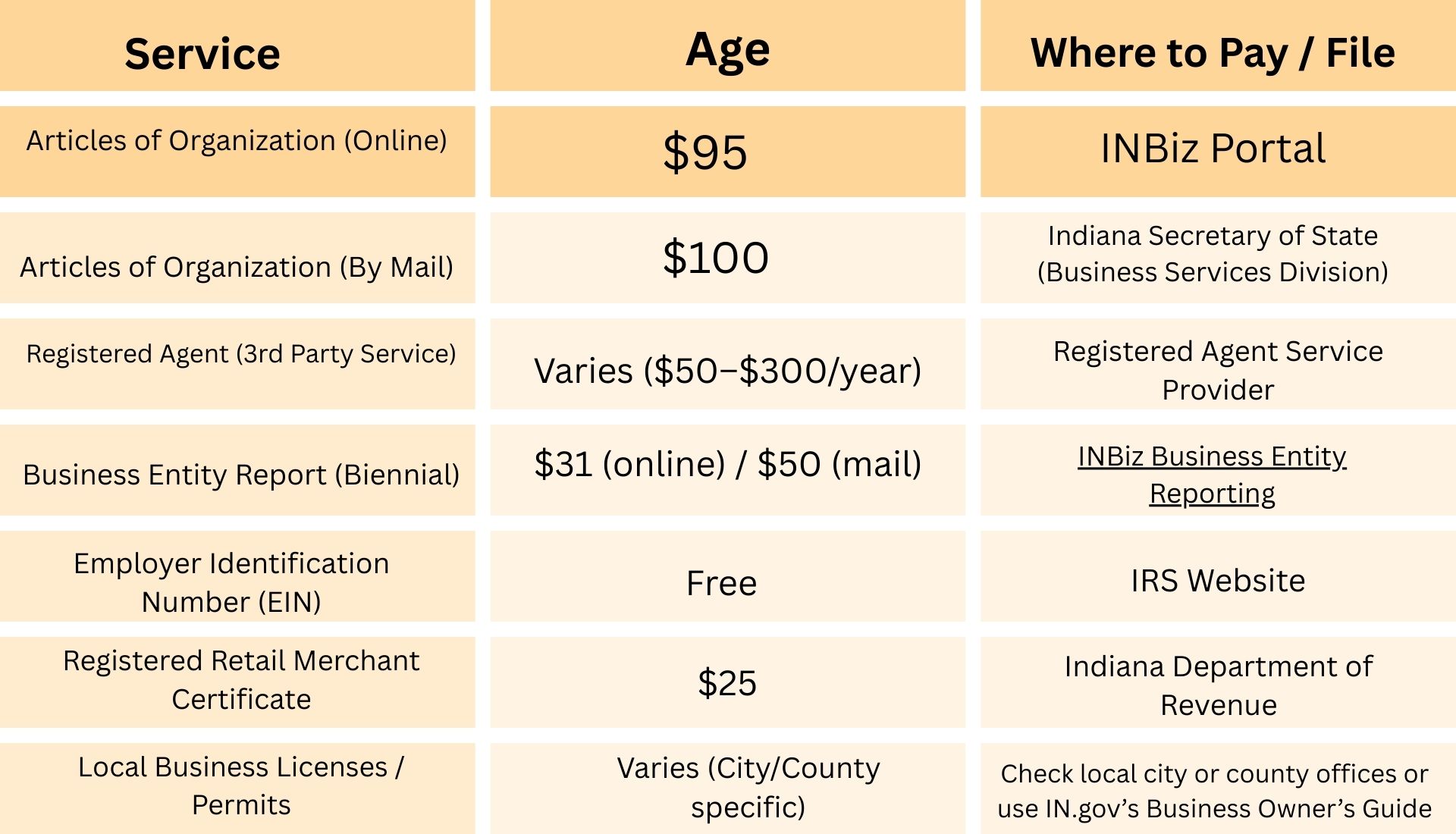

3. Pricing Information for Creating an LLC in Indiana

4. Ongoing Requirements for Your LLC

4.1 Biennial Business Entity Report

Indiana requires all LLCs to submit their Business Entity Report every two years to submit their current details on ownership administration and contact data.

- Every other year your LLC has to submit its annual update during the month it established itself.

- You may submit documents either through the INBiz Portal or by mail.

- Filing Fee: $31 (online) or $50 (mail).

Not filing your LLC report on time can lead to late fees and threaten your operating status of the business.

4.2 State Taxes and Regulatory Obligations

Although Indiana does not require your LLC to pay an annual franchise tax you must fulfill distinct state tax obligations based on your business operations:

- Sales Tax: You must register with the Indiana Department of Revenue. for sales tax duties when your business handles taxable transactions.

- Employment Taxes:You must register with the IRS and Indiana Department of Workforce Development when you work with employee hires.

- Business Licenses: Several regions and trades need specific business permits to run operations. You should get in touch with your local city or county clerk staff or look at the Business Owner’s Guide from IN.gov.

5. Why Starting an LLC in Indiana Could Be a Game Changer

Registering an LLC in Indiana provides valuable advantages that make becoming an entrepreneur here a smart choice. These are powerful reasons to take it into account.

1. Business-Friendly Environment

Indiana provides excellent conditions for startups and small businesses thanks to its affordable business environment and easy regulations. The state provides good conditions for various industries to develop including production services, pharmaceuticals and agricultural products with space for business growth. You can check business benefits for Indiana by visiting the web pages of Indiana Economic Development Corporation (IEDC).

2. Liability Protection

Starting an LLC in Indiana shields your personal money because it keeps business and personal finances separate from each other. Business owners start LLCs primarily because the company structure shields their predominant assets from financial risks. Visit the Small Business Administration website to find out how the LLC structure shields investors from business risks.

3. Enhanced Business Credibility

Starting an LLC in Indiana improves your business’s reputation with both customers and external partners. Your company shows its official status under state regulations when you operate as an LLC. When running businesses that sign contracts and serve customers over time this business setup brings great benefits. Use the Business Services Division website of the Indiana Secretary of State’s Business Services Division.

6. Is an LLC in Indiana Right for You? Potential Drawbacks

Although creating an LLC in Indiana brings advantages you should understand the possible difficulties that might influence your choice.

1. State Filing and Maintenance Costs

Although people consider Indiana affordable for business ventures they must continue paying state fees. An LLC requires companies to submit a Biennial Business Entity Report which incurs $50 online processing or $60 for mailing it in. Depending on your business activities obtaining required permits restricts your setup and upkeep costs. You can find all fee information for your LLC along with necessary requirements on the IN Secretary of State the Indiana Secretary of State’s Business Services.

2. Limited Privacy Protection

Indiana requires that certain business information be disclosed in public filings, including member or manager names and business addresses. For entrepreneurs seeking maximum privacy, this might be a concern. All submitted reports become part of public record. Visit the INBiz Filing Portal to explore what information must be disclosed.

3. Ongoing Compliance Obligations

Indiana public filings need companies to show business members’ or managers’ names and operating addresses. New business owners who value absolute privacy would want to consider other options. All business reports submitted appear permanently as official public records. On theINBiz Portal, users can find the details about the required disclosure information.

7. What to Do After You’ve Set Up Your LLC in Indiana

After your Indiana LLC formation ends you need to complete several necessary actions to stay legal and operational:

1. Obtain an Employer Identification Number (EIN)

To function as an LLC you need to get an Employer Identification Number to operate your business bank account, hire employees and submit federal taxes. Your LLC requires this number to operate as a separate business entity. You can get an Employer Identification Number at no charge by using the IRS EIN application page.

2. Register for Indiana State Taxes

The taxes you have to pay depend on your business activities since sales tax registration and withholding taxes can vary by operation. You need to do this registration process at the Indiana Department of Revenue platform. You need to register before selling items and hiring staff.

3. Apply for Local Business Licenses and Permits

Business owners need to check with their local authorities since Indiana does not provide a statewide business license but some businesses must obtain local permits. Consult with local authorities to receive details about necessary permits. The INBiz Licensing & Compliance section provides all information about licensing and compliance.

4. File Biennial Business Entity Reports

Your LLC maintains active status through submitting required Biennial Reports to the state every two years. The payment for this submission comes to $50 if done online and $60 through postal delivery. The INBiz portal offers an option to submit formation documents after the due date which results in dissolving your business.

5. Maintain Compliance and Records

Make sure to track all business ledgers and handle your state filings as well as tax and renewal tasks on schedule. Pursuing compliance tasks helps your LLC meet all operating requirements and remain fully active. The INBiz – Indiana’s Official Business Portal gives you detailed information on how to remain in legal standing.

8. Frequently Asked Questions (FAQS)

1. Do I need a lawyer to open an LLC in Indiana?

You do not need to employ a lawyer for setting up an LLC in Indiana. You can handle all LLC formation steps by accessing INBiz portal online services. If your business needs advanced legal help or you lack understanding about setup regulations then professional legal advice can assist you.

2. How much does it cost to start an LLC in Indiana?

The primary costs include:

- Articles of Organization filing fee: $95 (online) or $100 (by mail)

- You need to report LLC data every two years with a $50 online payment or a $60 mail payment. The full cost of starting an LLC in Indiana may include registered agent payment plus business license and professional service fees. Locate all fees information in the INBiz fees page.

3. How long does it take to form an LLC in Indiana?

- Online filings: Normally reach completion within one business day.

- Mail Filing: through mail requires a processing time of five to seven business days. INBiz online processing delivers the fastest service to business owners.

4. Are there ongoing requirements for starting an LLC in Indiana?

- An LLC needs three main requirements to stay in good standing with Indiana laws.

- You need to submit the Biennial Report every two years.

- Maintain a registered agent.

- Comply with the business and tax rules set by the State of Indiana

- Learn the precise qualifications from the information available on INBiz.

5. What is an Operating Agreement, and is it required in Indiana?

Your LLC needs an Operating Agreement to show how the business ownership and operation functions should work. Indiana does not need an operating agreement to construct your LLC legally; however, this helps prevent business conflicts and makes administration easier to comprehend.

6. Do I have to file taxes for an LLC if it has no income?

The tax filing requirements for an LLC depend on its structure despite earning no profits whether it contains one member or multiple members. To know your tax reporting needs you must talk with the Indiana Department of Revenue or an expert in taxes.

7. Can I form a single-member LLC in Indiana?

A single-member LLC may form in Indiana without any disadvantage when compared to multi-member LLCs because both types share identical liability protection and tax advantages.

8. Is forming an LLC in Indiana worth it?

Starting an LLC in Indiana protects you from business liabilities because its setup process is simple and state filing costs remain affordable. People who start their own small companies and businesses frequently choose LLCs in Indiana.

9. Do I need a lawyer to start an LLC in Indiana?

Business owners typically do not need a lawyer to form an LLC but having one can be beneficial when their operations involve difficult legal matters or state rules.

- What are the ongoing requirements for maintaining an LLC in Indiana?

You must:

- Submit your regular business report to INBiz online through their portal

- Stay on top of tax reports to the Indiana DOR.

- Keep your registered agent information updated with the state authorities.

Ill-maintained legal requirements will lead to late payment penalties or state authorities will dissolve your LLC.

6. Conclusion:

An LLC in Indiana helps business owners shield their personal assets from business risks while making their business more credible. You can achieve long-term business success through correct state requirements and proper step execution.

For complete filing procedures and official resources, visit the Indiana Secretary of State and Indiana Department of Revenue websites.