Do you intend to start up your own business venture in Arizona?

The Blog exists to help you navigate your substantial venture.

Starting an LLC in Arizona provides perfect startup business conditions for both small business owners, freelancers, and entrepreneurs. The LLC structure creates a business structure that enables asset protection and adaptable management as well as organisational capabilities.

Start an LLC in Arizona, regulations remain straightforward as long as you fulfil mandatory requirements such as business naming procedures, filing requirements and maintaining state regulatory standards.

This guideline presents complete instructions for establishing an LLC in Arizona for the upcoming year of 2025. This guide supports business launch success by simplifying complex information, providing both cost information and official documents from authentic resources to follow step-by-step.

Table of Contents

- Understanding LLCs in Arizona: Why It’s a Smart Move

2. Step-by-Step Guide to Forming Your Arizona LLC

3. Pricing Information for Creating an LLC in Arizona

4. Ongoing Requirements for Your LLC in Arizona

5. Why Starting an LLC in Arizona Could Be a Game Changer

6. Is an LLC in Arizona Right for You? Potential Drawbacks

7. What to Do After You’ve Set Up Your LLC in Arizona

8. Frequently Asked Questions (FAQs)

9.Conclusion: Ensuring Your Arizona LLC is Legally Protected

1. Understanding LLCs in Arizona: Why It’s a Smart Move

Understanding LLCs

Levis makes Limited Liability Companies (LLCs) a favoured business structure in Arizona because this arrangement provides protective aspects from corporations, together with basic tax structures that pair well with partnerships and sole proprietorships. Its flexible features make LLCs appropriate for entrepreneurs, small business owners and freelancers who need an operating system that is easily navigable, together with the protection of their personal assets.

Why Choose an LLC in Arizona?

Liability Protection

An Arizona LLC offers personal liability protection to its members (owners). Your personal possessions, including house real estate and saved money, normally remain safeguarded from court claims against the business entities.

Tax Flexibility

Under the default rules, Arizona regards LLC business entities as pass-through business entities for tax purposes. Pass-through taxation occurs in this setup because LLC business income moves directly to individual members, whose personal tax returns process the taxes while avoiding double taxation of corporations. Businesses within an LLC structure can select S Corporation or C Corporation taxation if an S Corporation better meets their financial needs.

Operational Simplicity

Arizona LLCs maintain a simple management structure thanks to their lack of requirements for formal corporate practices that corporations need to execute. Your business benefits from freedom in choosing either member-management or manager-management according to your operational needs.

Credibility

Your company image strengthens when you establish an LLC business entity. The registration demonstrates a commitment to professionalism by proving to stakeholders that you maintain business compliance and organisational structure.

No Annual Report Requirement

In Arizona, the mandatory filing of annual reports for LLCs does not exist, which means small business owners save costs and time. The requirement to maintain current statutory agent details remains a responsibility,y while you must follow publication requirements if needed.

For more details and official guidelines, visit the Arizona Corporation Commission (ACC).

To directly access LLC formation instructions, go to the official ACC website.

For information on Arizona taxation and LLCs, visit the Arizona Department of Revenue.

2. Step-by-Step Guide to Forming Your Arizona LLC

2.1 Choose a Unique Name for Your LLC in Arizona

A legally acceptable business name serves as the initial step for opening an LLC in Arizona. An LLC business name needs to both represent its brand identity and comply with the legal requirements of the Arizona Corporation Commission (ACC) naming requirements.

Guidelines for Naming Your Arizona LLC

1. Verify Name Availability

Check that your selected business name is free for use by other Arizona entities before filing. You can do this using the ACC’s Name Availability Search tool.

2. Follow Arizona Naming Rules

The name of your LLC should end with one of these three elements: Limited Liability Company, L.L.C., or LLC.

“Limited Liability Company”

“L.L.C.”

“LLC”

Certain terms that make the business appear linked to government operations require special permission or must be approved by the state entity.

For a full list of rules, refer to the ACC’s naming requirements.

3. Reserve a Name (Optional)

You can reserve your business name for 120 days when you have not yet filed your LLC by using our Name Reservation application system. Find the Name Reservation Form under the Corporation and LLC forms.

4. Check Domain Availability

Prior to starting your business, you should verify if an online domain that matches your name is open for registration. Your visual images should appear the same in every part of your online presence.

Helpful tip: You can discover new business name ideas using an online tool to help when you find selection difficult. After creating your list of possibilities, look them up on both the ACC and GoDaddy or Namecheap search tools to see if the names can be registered.

2.2 Appoint a Registered Agent in Arizona

Each LLC in Arizona needs to have a Statutory Agent accept official documents and correspondence for the business at the designated location.

Your representative in Arizona must maintain a street-level business location to accept documents during usual operating hours.

What to Consider When Choosing a Statutory Agent:

- Dependability

Work with a proven registered agent service or choose a dependable person to accept and protect your legal paperwork. - Availability

Papers delivered through the mail need physical representation by the agent during office hours from 9 AM to 5 PM at their specified Arizona address to pick them up. - Legal Compliance

Under Arizona Corporation Commission (ACC) rules, your statutory agent must:

- Reside within the state of Arizona or serve as an approved business with an Arizona address.

- You need business permission from the Arizona state authorities to manage business operations.

- Keep an up-to-date physical address in the Arizona state location.

- Provide written approval to the state that you will serve as the legal representative for your company.

A Statutory Agent Acceptance form is necessary during your Articles of Organisation submission

Additional Notes:

- You can serve as the statutory agent, but you need to stick to all legal criteria that applicants must follow.

- The LLC itself cannot serve in the role of its appointed agent.

- Most people prefer to use professional statutory agent services for easy, reliable service.

2.3 File Articles of Organisation in Arizona

To officially form your LLC in Arizona, you must file Articles of Organization with the Arizona Corporation Commission (ACC). Your Articles of Organisation set up your business legally through details like your LLC name, agent information, company address, and organisational style.

Filing Process for Arizona LLCs

- Prepare Your Information

Before you file have all these elements available:

Companies do business under their LLC name, which needs to be one-of-a-kind and match state naming standards in Arizona.

Business address

Name and address of your Statutory Agent

Your LLC operates either by members who manage it or by appointed managers.

- Complete the Articles of Organisation Form

You can file your Articles either through an Internet connection or through physical delivery. The officially recognised document has the title Articles of Organisation – L010 if filed on a paper basis. - Submit the Form and Pay the Filing Fee

- Online filing: Use the ACC eCorp portal for faster processing.

- Filing fee: You must pay $50 to file the documents with an optional $35 fee for quick processing.

- Mail or In-Person: The Arizona Corporation Commission at 1300 W. Washington St. in Phoenix.

Arizona Corporation Commission

1300 W. Washington St.

Phoenix, AZ 85007

2.4 Create an Operating Agreement in Arizona

Arizona does not enforce this requirement, but businesses should create an Operating Agreement to run their operations successfully. This internal document tells your company what roles every person plays in running the business, including how the business is owned.

Having this document ensures that your LLC operates smoothly and guards your business interests even when problems arise.

Why an Operating Agreement Is Important in Arizona

- Establishes Internal Structure and Rules

The agreement defines proper governance and spells out how the LLC is run through both member and manager control including voting rules and business roles. - Helps Preserve Limited Liability Status

The Operating Agreement helps your LLC remain a separate legal entity for business operations by assigning each company asset a distinct role. The framework assists in business operations, especially during court situations and bank or investor relations. - Reduces Member Disputes

A properly written company agreement reduces staff disputes by explaining decision-making orders, conflict resolution formats, and departure rules for members. - Supports Legal and Financial Transactions

Bank investors and lawyers need to review the Operating Agreement when they handle business banking arrangements and business transactions.

Key Contents of an Arizona LLC Operating Agreement

- LLC name and principal address

- Names and roles of members or managers

- Capital contributions of each member

- Distribution of profits and losses

- Voting rights and decision-making process

- The rules govern who can join or exit the company as part of its membership.

- Procedures for dissolving the LLC

2.5 Obtain an Employer Identification Number (EIN)

Your LLC needs an Employer Identification Number (EIN) for business operations such as tax filing and employment because it serves as a distinct identifier similar to a Social Security number. The IRS supplies EIN registration for free by offering users an online registration option on its website or via mail submission.

You have to find and understand the Arizona-specific rules regarding business licenses and state taxes that affect how LLCs pay taxes. If your LLC sells goods or taxable services, you may need to register for the Transaction Privilege Tax (TPT) through the Arizona Department of Revenue. Additionally, if you have employees, you’ll need to register for withholding tax and unemployment insurance tax.

For more information, visit the Arizona Department of Revenue website.

2.6 File the Initial Statement of Information

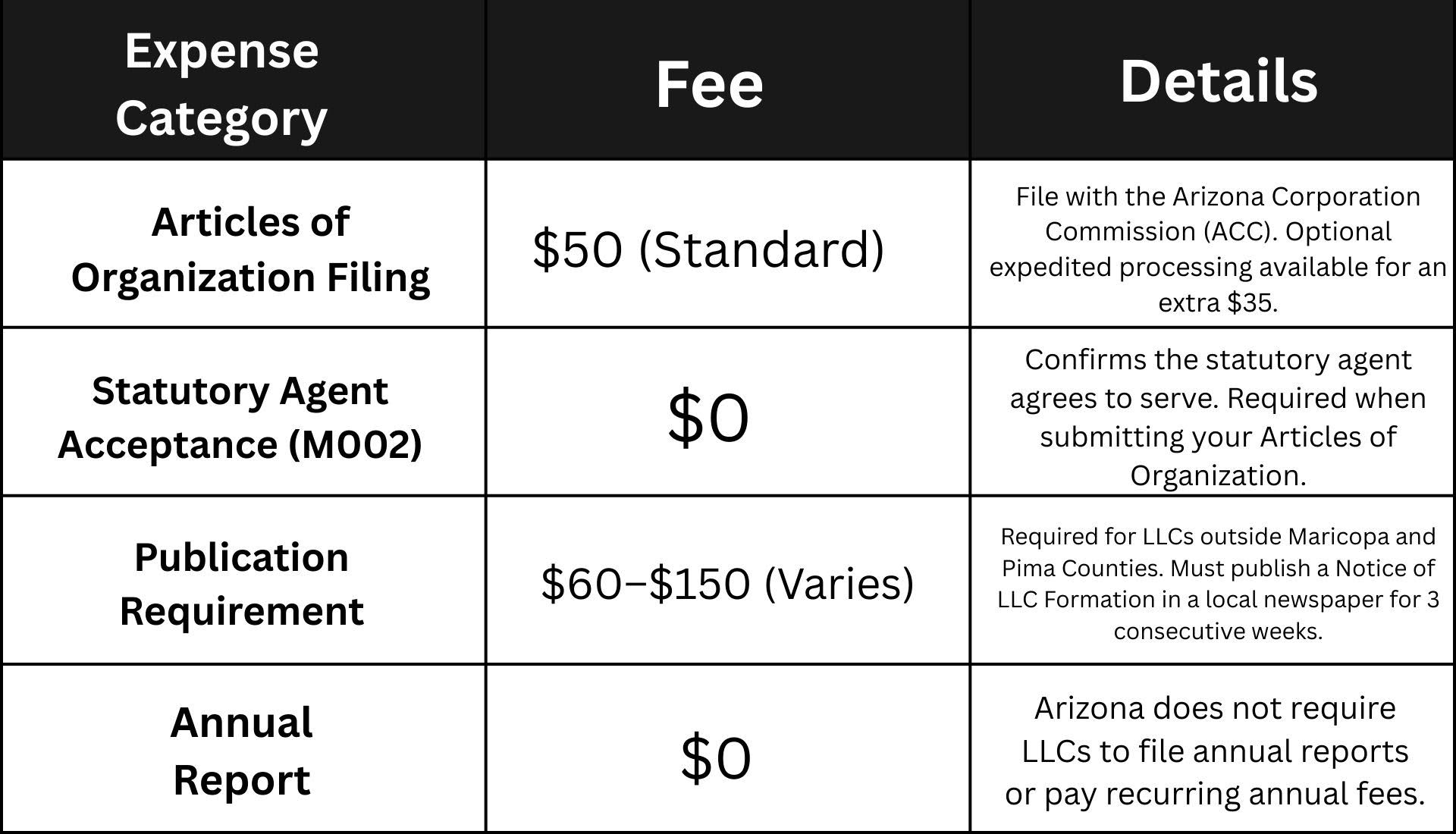

In Arizona, to form an LLC you submit both the Cover Sheet along with Articles of Organization yet unlike California no separate Initial Statement of Information is needed. An LLC based outside Maricopa or Pima County needs to publish a Notice of LLC Formation in a local newspaper.

You must print your LLC establishment announcement to appear three times straight in chosen local newspapers that recognize the county where your business based itself.

You need to pay newspaper-specific filing costs that range from $60 to $100.

Keep the affidavit of publication the newspaper sends you for reference once your publication finishes. The Arizona Corporation Commission does not need your newspaper publication when it is not required.

Publication on time helps your LLC meet Arizona state requirements and maintain its active status. For more details, visit the Arizona Corporation Commission website.

2.7 Register for State Taxes and Obtain LicensesState Taxes

Your business must fulfil state tax registration requirements and obtain necessary Arizona licenses depending on its operations.

Transaction Privilege Tax (TPT) License:

An LLC must register for a TPT license (call it sales tax license) at the Arizona Department of Revenue if product sales and service types fall within their scope. A sales tax license is necessary for all physical and online retailers throughout Arizona.

Employment Taxes:

You need to sign up with the Arizona Department of Economic Security and the Arizona Department of Revenue for employee tax registration before bringing staff members onboard. You must finish the registration process before starting payments to your employees.

Business Licenses and Permits:

Your LLC must obtain specific licenses based on its business type and operating location. Through their local authorities, many cities and counties across Arizona need business licenses from new companie,s even though such licenses do not exist statewide. Use the Arizona Commerce Authority’s Small Business Services and AZDOR’s License Compliance page to find which licenses and permits apply to your business.

3. Pricing Information for Creating an LLC in Arizona

4. Ongoing Requirements for Your LLC Requirements

4.1 Annual Franchise Tax

The state of Arizona does not require a yearly business taxation for LLCs. Your LLC needs no annual state tax payment although you must register for special tax categories if your business applies.

4.2 Annual/Biennial Report

Under Arizona laws, LLCs do not need to submit regular updates about their business activities. Your business needs to maintain accurate statutory agent and other company information with the Arizona Corporation Commission.

5. Why Starting an LLC in Arizona Could Be a Game Changer

Setting up an LLC in Arizona gives entrepreneurs powerful benefits that draw their attention. Some of the key reasons are:

-

Access to a Large Market

Arizona provides excellent business conditions and access to a diversified market through its geographical location. The state of Arizona supports companies across the technology, manufacturing, healthcare and agriculture fields, which creates many potential clients for businesses to serve. The developing Arizona economy offers promising opportunities for business owners setting up their businesses. The Arizona Commerce Authority offers additional data about business conditions in the state.

-

Liability Protection

An LLC shields personal funds from business hazards through legal protection of company financial obligations. When you register an LLC in Arizona, you shield your personal savings from taking responsibility for your business debts. LLCs work as a protective barrier for business owners. Learn about the ways LLCs shield their founders from business responsibility by visiting the U.S. Small Business Administration (SBA).

-

Credibility

Running your enterprise as an LLC raises its professional profile. Companies doing business in Arizona as LLCs gain credibility because the state offers supportive regulations for investor and supplier concerns. Arizona’s strong business reputation helps companies that need customers and suppliers to trust their operations. Visit the Arizona Secretary of State’s website for complete information about building a trustworthy business in Arizona.

6. Is an LLC in Arizona Right for You? Potential Drawbacks

People creating Arizona LLCs will discover advantageous options yet must weigh specific unfavourable aspects before starting their business.

-

High Fees and Taxes

Since Arizona holds a good position among US states for taxation LLC owners have to prepare for paying specific charges. Every year LLCs in Arizona need to pay $50 to submit their document of organisation. Arizona demands state income tax from business revenues, with payment rates set according to total business income. To learn about income tax requirements for state businesses, visit the Arizona Department of Revenue.

-

Complex Regulations

Although Arizona promotes business growth, it maintains specific rules that LLC owners need to respect. A business must meet different types of rule sets in its field, such as location permits, environmental standards, and work conditions. New business owners need legal help to handle state rules and prevent financial burdens from unenforced regulations. Our article provides all the necessary information about business regulations. Visit the Arizona Corporation Commission.

-

Ongoing Compliance

Arizona demands that LLCs file their yearly reports in order to continue holding their official business status. Although it has fewer than most states, Arizona holds LLC compliance deadlines that trigger penalties or legal consequences for missed filing deadlines. Arizona LLCs need to fulfil all regular tax reporting duties alongside their company operations. For more information on compliance requirements, visit the Arizona Secretary of State’s website.

7. What to Do After You’ve Set Up Your LLC in Arizona

Your Arizona LLC needs specific steps to become a legal business and work smoothly:

-

Obtain an Employer Identification Number (EIN)

You must have an EIN to deal with tax obligations and open your business bank account. The IRS offers their EIN application services for free. You can do the application steps directly on the IRS website.

-

Register for State Taxes

To conduct business in Arizona, you must sign up for required state taxes, which vary depending on your business operations. To register for these taxes, you must contact the Arizona Department of Revenue (ADOR). Check all steps carefully when starting a business, including product sales or hiring staff, because specific procedures apply in both cases.

-

Obtain Necessary Permits and Licenses

All Arizona businesses need to get official permissions and official papers from their work sector. All businesses that sell taxable items must get a seller’s permit, while local business licenses are issued based on zone or health department regulations. You need to follow every rule that protects Arizona area businesses. Refer to the Arizona Commerce Authority for guidance on necessary licenses and permits.

-

Maintain Your LLC’s Good Standing

You keep your Arizona LLC in good standing through annual reporting, along with proper recordkeeping. Your business needs to fulfil all tax laws and government submission requirements so your company remains officially in good standing. Look up essential information about good standing and compliance requirements on the Arizona Secretary of State’s website.

8. Frequently Asked Questions (FAQS)

-

Do I need a lawyer to open an LLC in Arizona?

Starting an Arizona LLC does not require legal counsel under Arizona state law. Entrepreneurs should submit essential documents to the Arizona Secretary of State for autonomous LLC creation. Business owners who need help with particular legal or business matters should or should not work with a legal professional, depending on their individual needs.

-

How much does it cost to start an LLC in Arizona?

Arizonan businesses must pay different fees as they create their LLC, which encompasses multiple expenses during the process.

- Articles of Organisation Filing Fee: $50

- There is no annual report fee obligation for LLCS in Arizona because regulations do not mandate such a payment.

- The fees charged by registered agents differ according to the provider’s service selected.

- The prices of local business licenses and permits depend on the specific city and characterise the business operations.

- An LLC in Arizona must pay optional professional and legal service costs, which have varying prices according to the required services.

-

How long does it take to form an LLC in Arizona?

Arizona allows LLC formation processing which takes the following amount of time:

- Online filings with Arizona typically need 7 to 10 business days for completion.

- Postage-based filings usually need four to six weeks for processing.

- An expedited processing service through the state can be obtained by paying extra fees.

-

Are there ongoing requirements for starting an LLC in Arizona?

Your Arizona LLC needs the following requirements to keep its good standing status:

- Arizona does not have an annual report obligation; however, maintaining accurate business records is necessary.

- When operating in Arizona it is important to file state taxes, including sales taxes, together with employee taxes.

- Business Regulations Compliance Demands that you maintain your adherence to all required local licenses or industry permits.

Not obeying Arizona’s requirements for operating an LLC could result in disciplinary actions that include suspending your business entity.

-

What is an Operating Agreement, and is it required in Arizona?

Your LLC requires an Operating Agreement that details organization principles, governance structures and operational procedures. The State of Arizona does not mandate Operating Agreements for businesses, although such documents highly benefit all parties involved. The agreement helps avoid misinterpretations which results in efficient business operations.

-

Do I have to file taxes for an LLC if it has no income?

Businesses operating as LLCs in Arizona need to submit their annual report to state authorities while also potentially needing to report taxes regardless of revenue earned. Sanctioned penalties may occur when LLCs neglect their required filing obligations along with the possibility of state-imposed minimum taxes.

-

Can I form a single-member LLC in Arizona?

Arizona provides permission to establish single-member LLCs as part of its business regulations. The LLC structure offers personal asset protection to owners by safeguarding them from business liabilities, yet maintains high organisational freedom when it comes to supervision.

-

Is forming an LLC in Arizona worth it?

Establishing an LLC in Arizona brings numerous advantages, including liability coverage, quick formation processes and minimal compliance duties. Entrepreneurs should evaluate their business requirements before finalising their decision, since some factors may outweigh the advantages of forming an LLC.

-

Do I need a lawyer to start an LLC in Arizona?

The Arizona state government does not require legal advice for forming an LLC, but business owners may seek professional advice to handle specialised legal matters or complicated organisational structures.

-

What are the ongoing requirements for maintaining an LLC in Arizona?

Arizona LLCs must:

- Arizona business owners do not need to submit annual reports because the state does not require annual payment fees.

- Ensure tax compliance

- Arizona LLCs need to maintain both business permits and licenses according to their specific industry’s requirements.

The non-compliance with tax regulations alongside business license requirements creates the risk of LLC suspension and incurs penalties.

6. Conclusion:

Establishing an LLC in Arizona gives business owners protective measures for their personal assets as well as improved business reputation. You can build a successful LLC through compliance with state regulations, along with the adoption of the steps detailed in this guide.

The Arizona Corporation Commission, together with the Arizona Department of Revenue, maintain full filing procedures and official resources which are available on their websites.