Secure your business foundation with an LLC in Illinois.

The process to start an LLC in Illinois allows you to protect your personal assets while maintaining full concentration on business growth and success.

Starting an LLC in Illinois requires more than form submission because it builds a permanent future within this business-welcoming state environment. These guidelines function as a dependable tool for new entrepreneurs seeking startups as well as organisations seeking new market entry.

The guide provides useful instructions and vital official resource links with experienced guidance to give you confidence throughout your journey.

Professional assistance will transform your business vision into an operational firm that follows all legal requirements.

Table of Contents

- A Fresh Look at Business Structures: Why Choose an LLC?

- Step-by-Step Guide to Forming Your LLC in Illinois

- Keys to Long-Term Success

- Final Thoughts and Next Steps

A Fresh Look at Business Structures: Why Choose an LLC?

A new business demands careful strokes between innovative approaches and defensive measures. An LLC creates an excellent situation for business owners to maintain adaptability with streamlined legal requirements. The main difference between a sole proprietorship and an LLC is their separate legal entity status. The legal entity status of an LLC creates protection for your personal home and savings from business-related risks. The pass-through taxation feature of LLCs enables owners to avoid paying twice the taxes that most corporations must endure.

Interested in more detailed information? The Illinois Secretary of State’s LLC Formation Instructions provide deeper insights into these benefits.

Step-by-Step Guide to Forming Your LLC in Illinois:

Choose a Unique Name for Your LLC in Illinois

A business name delivers the initial impression that customers receive of a brand. Creativity needs to combine with official requirements along this path. Your business must stand out from its competition in order to meet state requirements by following this advice.

Make It Unique:

Check that your business name stands alone during the initial stages of the Illinois LLC registration process. Visiting the Illinois Business Entity Search system helps you verify your name’s uniqueness against the existing business entities. A one-of-a-kind business name assists in avoiding legal issues while simultaneously promoting better brand recognition.

Official Naming Convention:

Your business name should always incorporate the designators “Limited Liability Company,” “LLC,” or “L.L.C.” at the conclusion. All stakeholders will learn about your company’s status through this information.

Avoid Confusing Terms:

Avoid using phrases which could create false impressions about government affiliation, especially when phrases include “FBI” or “Treasury”. For full requirements, see the Illinois Naming Guidelines.

Digital Domain Check:

Checking the availability of your business name is a fundamental requirement in the process of getting an LLC in Illinois. The Illinois Secretary of State offers authorized tools to help you with this process:

- Business Entity Search: The Business Entity Search tool enables you to discover if your potential LLC name exists or contains elements that are too similar to current business entities. The tool enables you to verify that your selected business name has no previous use and meets the requirement of state-level uniqueness.

- Corporate Name Availability Inquiry: For a more detailed check, you can use the Corporate Name Availability Inquiry Form. The form permits businesses to check whether a specific corporate name is available, and the Secretary of State’s office will send confirmation about its availability. The information provided through this initial inspection does not serve as a definitive confirmation.

Helpful Hint: Business name generators assist firms in creating suitable name options for organizations that face difficulties generating distinctive names.

The Essential Role of a Registered Agent

All legal correspondences and official documents flow through the registered agent, who functions as the official point of contact for the business. The legal requirement for opening an LLC in Illinois mandates that someone serve in this position.

What Makes a Great Registered Agent?

- Local Presence:

The agent needs to maintain an Illinois-based physical address since P.O. Boxes fail to qualify. All important legal documents can be received immediately through this requirement.

- Reliability & Consistency:

These agents need to provide service during normal business hours for quick response to important notices, which may arrive at any time.

- Professionalism:

Some organizations opt to delegate IT management tasks to specialized vendors because self-maintenance proves too complicated for them. More details can be found on the Illinois Secretary of State’s Registered Agent Information page.

Make a decision regarding self-representation against utilizing professional services that optimize performance flow.

The Road to Legal Formation: Articles of Organization

The legal formation of an LLC requires you to submit the Articles of Organization to official state records. Through this document, you will notify the state completely about all business details.

The Process in a Nutshell:

- Prepare Your Information:

The first step requires collecting crucial information about your business, including its name, principal office location, agent registration, and company organization.

- Complete Form LLC‑5.5:

This is Illinois’s official document. The form is accessible through both the Internet and postal mailing options for completion. To get started, visit the Illinois Secretary of State’s Business Services page.

- Pay the Filing Fee:

The application fee amounts to $150, which is paid only once during the process. Add the filing fee during your application, as it will speed up the processing time for your document.

Your LLC receives its official legal status at this stage as a separate corporate entity. Document maintenance at this point establishes a secure base for future business expansion.

Creating a Blueprint as Your Operating Agreement

The state of Illinois does not mandate operating agreements, but creating one brings key benefits to your business organization. The LLC operational process becomes clear through this internal document.

Why Should You Have an Operating Agreement?

- Clarification of Roles:

Your agreement must determine the processes for decision-making alongside member responsibilities regarding the distribution of profits and losses. Such arrangements reduce the potential for conflicts which could occur later in time.

- Legal Safeguard:

The document strengthens your legal protection by keeping business operations separate from personal operations, which protects your limited liability protections.

- Conflict Resolution Mechanism:

A conflict resolution mechanism founded within the operating agreement enables smooth dispute management to avoid business disruption.

The operating agreement can be created by using resources from LegalZoom either on your own or with the help of an attorney from your local region.

Securing Your Business Identity: Getting an EIN

Your business needs an Employer Identification Number (EIN) to identify your LLC properly and enable essential tax reporting and business bank account establishment.

How to Apply for an EIN

Quick & Free Application:

An EIN can be acquired seamlessly from the IRS EIN Online Application. Free application services generate your Employer Identification Number (EIN) right after the completion. Third-party websites that charge to obtain EINs should be avoided because you can always get this identifier completely free from the IRS.

Use the EIN Everywhere:

Your business finds official identification through your EIN after its successful acquisition. All companies need to use an EIN for federal tax obligations, staff hiring, and bank account setup purposes.

The public can access extra federal guidance at IRS Small Business and Self-Employed Tax Center.

Compliance and Licenses: Permits to Prosperity

Your business or website needs every required permit and license to start operations properly. Your customers will increase trust in your business by following these regulations and achieving legal protection.

Steps to Secure Your Permits and Licenses:

- Research Requirements:

Research which permits and licenses exist for your particular industry. The specific requirements include general business authorization alongside specialized authorization such as restaurant health permits. Begin your enquiry with the Illinois Department of Financial & Professional Regulation to obtain industry-related information. - Local Regulations:

To understand the permits required by your location, visit your local city or county clerk’s office. The local authorities maintain complete instructions and appropriate forms accessible through their online platforms.

- Application Process:

The application process requires strict adherence to official instructions and all necessary documents that must be submitted. Associating fees accompany most permits, requiring you to allocate budgetary funds in advance.

Your business requires all necessary permits alongside licenses to operate legally and run smoothly.

Maintaining Your Business Legacy: Annual Reporting

Protecting your LLC status in the state requires you to submit annual reports. Your business must submit updated information to the Illinois Secretary of State through this reporting system to maintain compliance status.

Key Points About Annual Reports:

- Filing Requirements:

While Creating an LLC in Illinois, you must file annual reports that require business contact and operational information. - Cost Implications:

The annual filing requires a $75 payment to the Illinois Secretary of State.

- Important Deadlines:

Identify your annual filing deadline through the information provided by your LLC’s formation date to prevent administrative dissolution and associated penalties.

You should handle annual reporting activities to protect your business reputation while ensuring business continuity.

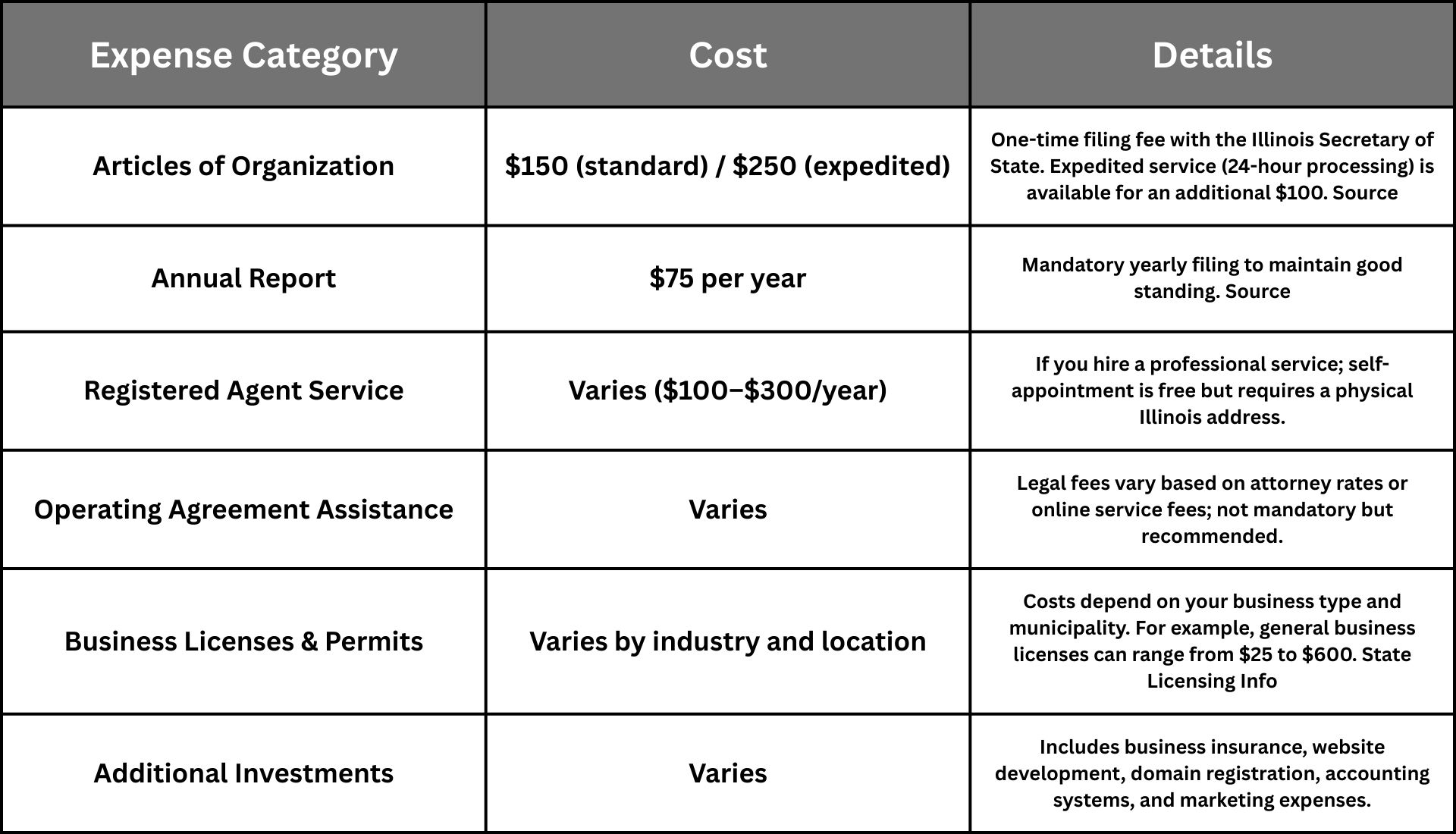

Counting the Costs: A Breakdown of Expenses

Keys to Long-Term Success

Your LLC’s formation is just the beginning. Sustaining and growing your business will require ongoing effort and strategic planning. Consider the following steps for long-term success:

- Separate Finances Rigorously: Business funds should have their own separate account, which will help distinguish between personal funds and business assets. Good financial records combined with distinct business-personal funds protect both your rights and accounting practices.

- Invest in Comprehensive Insurance: Your business should buy suitable insurance policies that are defended against unexpected events. The Illinois Department of Insurance maintains insights about multiple insurance options you can select as a small business owner.

- Keep Meticulous Records: Keep professional records containing full documentation about money transactions and business decisions, together with paper trails for every business communication. Detailed recordkeeping produces outcomes that simplify tax preparation processes and assist in dispute resolutions that may occur in the future.

- Comply Proactively: Make sure to manage deadlines that involve submitting annual reports together with permit renewals and tax filings. Check the Illinois Secretary of State’s website frequently to receive updates about state compliance necessities.

- Enhance Your Brand: You should create an interactive digital profile through both a good website presence and active social media pages. The zoviz tools allow you to build websites that showcase your brand identity in an attractive manner.

- Expand Your Network: Business owners should develop networking relationships through local chambers of commerce and online discussion platforms. Your new business connections can give you specific guidance. They will also potentially create collaborative partnership possibilities.

- Seek Expert Guidance: Your ability to understand and optimize your business strategy, together with handling complex regulatory environments, can be enhanced by regularly consulting with legal experts and financial advisors.

11. Final Thoughts and Next Steps

The process of setting up an LLC in Illinois brings forth both excitement and business rewards. The right preparation combined with suitable tools enables you to establish enduring assets needed for your immediate requirements and sustained development. The process of picking a business name, along with filing annual reports, contributes to the success and integrity of your business start-up.

The road of entrepreneurship demands permanent education and growth as you continue ahead. Staying up-to-date with rules requires using official resources provided by the Illinois Secretary of State and IRS and local agencies.

The Illinois process for applying for an LLC establishes both legal safety and demonstrates your dedication to operational success as a business operator. An effective business strategy alongside proper record management and defined goals allows Illinois-based enterprises to prosper within an evolving market.

Seize the moment right now to make your business vision into existence and build a permanent mark on the world.