Thinking of starting a business in Florida?

Then, Start an LLC in Florida to protect your personal assets, reduce paperwork, and enjoy flexible tax options.

Starting an LLC in Florida serves entrepreneurs by providing legal protection but with an easier structure than corporate entities. People choose an LLC business structure more often because of its benefits.

Each step needed to setup an LLC in Florida during 2025 is explained in this straightforward program. The guide contains everything required for Sunbiz submission and business name selection alongside Florida compliance requirements and filing procedures.

The Florida Department of State (Sunbiz), together with the IRS and exceptional formation service providers, provide transparent direction throughout every stage of your process. You can find step-by-step instructions about how to create an LLC in Florida through this guide.

Table of Contents

- Understanding LLCs in Florida: Why It’s a Smart Move

- Step-by-Step Guide to Forming Your Florida LLC

- Pricing Information for Creating an LLC in Florida

- Ongoing Requirements for Your Florida LLC

- Who Can Launch an LLC in Florida?

- Why Starting an LLC in Florida Could Be a Game Changer

- Is an LLC in Florida Right for You? Potential Drawbacks

- What to Do After You’ve Set Up Your LLC in Florida

- Frequently Asked Questions (FAQs)

- Conclusion: Ensuring Your LLC is Legally Protected

Understanding LLCs in Florida: Why It’s a Smart Move

Entrepreneurs benefit from starting a Limited Liability Company (LLC) in Florida to defend personal resources and take advantage of beneficial tax regulations and adaptable management structures.

Key Advantages of a Florida LLC:

- Personal Asset Protection: A Florida LLC formation protects your personal home and financial savings by segregating them from all business debts and liabilities.

- Tax Benefits: Business profits from Florida LLCs undergo pass-through taxation, which prevents them from being taxed twice at corporate and individual levels. The state of Florida is offering additional tax benefits because it does not have any state income tax.

- Operational Flexibility: LLCs in Florida offer flexible management structures. Florida LLC owners make a decision between running their business through member oversight or delegating management to an appointed individual while deciding how profits and losses should be distributed among members.

The process of Starting an LLC in Florida delivers advantageous benefits to business proprietors who want to safeguard their individual assets while optimizing taxation and maintaining corporate authority.

Step-by-Step Guide to Forming Your Florida LLC

Choose a Unique Name for Your LLC in Florida

Florida businesses that want to create an LLC need to select a business name first which matches their brand identity and follows state regulations. Check that the business name you pick is not currently owned by another company operating in Florida. Your business name needs to end with “LLC” or “L.L.C.” or “Limited Liability Company” according to Florida state laws.

To select a unique business name according to Florida regulations, follow this procedure.

- Verify Name Availability: The Florida Division of Corporations Business Search tool enables businesses to verify if any existing business holds their desired name.

- Adhere to Naming Standards: Pay attention to words that suggest ties with government agencies because phrases containing “Agency” and “Commission” or “Department” and “Bureau” and “Division” or “Municipal” or “Board” may raise misconceptions.

- Plan Your Digital Footprint: Consistently build your business online by confirming the availability of matching domain names that create seamless platform integration.

Helpful Hint: Business name generators can help companies generate possible names which support their goals when they struggle to develop unique names.

Appoint a Registered Agent for Your LLC in Florida

A Florida LLC must select a registered agent to receive official business documents on behalf of the company. The registered agent needs to operate from a Florida-based address (excludes P.O. Boxes) because this ensures regular business hours delivery of official documents to the business.

Selecting a registered agent requires you to weigh these factors:

- Dependability: Pick an individual or professional firm that shows evidence of trustworthiness when it comes to safeguarding and delivering private documents rapidly.

- Availability: The agent must stay at their official address throughout regular business days since they need to handle essential documentation physically.

- Legal Compliance: All agents must preserve Florida state requirements through a physical address in Florida and availability during regular business hours.

A Florida LLC cannot serve as its own designated receiving party for legal documents. Corporate registered agents you choose must maintain Florida business authorisation status and file their Corporate Registered Agent application at the Florida Division of Corporations.

Obtain State Business Permits for Your LLC in Florida

The operation of a Florida LLC requires business licenses or permits according to your industry and location.

Here’s how to get started:

- Check Local and State Requirements: Identify your required licenses by using Florida’s Business Information Portal which provides data based on your business classification and location.

- Apply for Licenses: The Florida Department of Business & Professional Regulation (DBPR) distributes licenses designed for particular industries, including construction, real estate and hospitality.

- Submit Applications and Fees: Complete the required documentation while paying applicable charges.

File Articles of Organization

The Florida Division of Corporations needs your Articles of Organization submission to establish an official LLC in Florida. People can submit the Articles of Organization through the Florida Division of Corporations both electronically and by postal mail services.

Steps to file:

- Gather Business Information: Start by obtaining information about your LLC, including its distinct name with “Limited Liability Company” or “LLC” and “L.L.C.” and your main business location and your chosen registered agent, as well as details about your management structure.

- Complete the Form: Use the Form through either the online or PDF options.

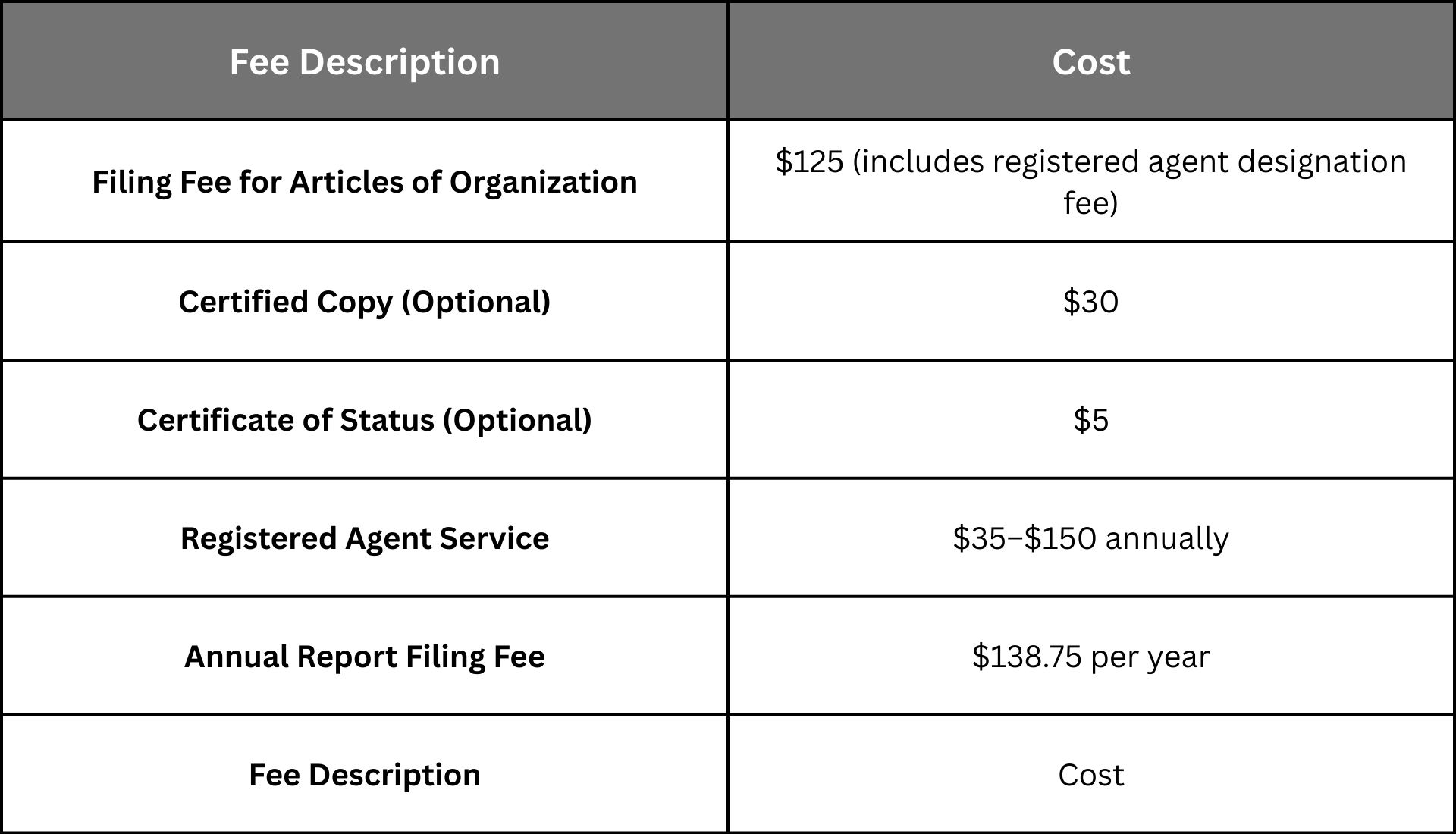

- Submit and Pay Fees: The standard filing cost amounts to $125 for the submission process. A certified copy purchase costs $30, while additional fees of $5 apply for a certificate of status.

For detailed instructions, refer to the Filing Instructions.

Draft Your LLC Operating Agreement

Florida does not require operating agreements, but such documents are strongly recommended because of their many advantages. An internal document of your LLC explains how ownership functions within the company, along with roles and procedures that guide operations.

Importance of an operating agreement:

- Clarifies Business Rules: The operating agreement sets specific rules for members to follow about business operations along with dispute handling.

- Protects LLC Status: The operating agreement helps your LLC keep its status separate from its owners by showing it operates as a distinct legal business entity.

- Prevents Misunderstandings: The document reduces disputes between members by presenting clear rules for business operations.

Apply for an EIN and Understand Tax Obligations

A business entity requires an Employer Identification Number (EIN) to serve as its equivalent of the social security number. Transacting business requires an EIN for employee recruitment, banking operations, and tax reporting.

How to obtain an EIN:

- Apply Online or by Mail: The IRS provides free EIN registration.

Understand your tax obligations:

- Federal Taxes: The self-employment tax members of LLCs pay a sum of 15.3%, split into 12.4% for Social Security and 2.9% for Medicare expenses.

- State Taxes: Individuals operating in Florida do not pay state income taxes, and multiple taxation requirements may affect your business operations. For more information, visit the Florida Department of Revenue.

Organise Annual Reports

Florida demands that all LLCs file annual reports at the Division of Corporations to maintain accurate business data.

Key points:

- Know Due Dates: The annual report deadline occurs every year and runs from January 1 to May 1.

- Maintain Proper Records: Associate detailed records with your business each year to facilitate smoother report maintenance.

- Submit and Pay Fees: Businesses filing annual reports should submit their documents at a fee of $138.75 to the Division of Corporations.

You can file your annual report through the annual Report Portal.

Cost Breakdown for Starting an LLC in Florida

Why Starting an LLC in Florida Could Be a Game Changer

The Florida environment provides several benefits to entrepreneurs who decide to establish their LLCs there. Some of the key reasons are:

- Access to a Thriving Market: The diverse economy of Florida makes it possible for businesses to reach many different markets through its thriving opportunities. Florida serves as a base for successful tourism services and healthcare institutions, and it also includes farming operations and real estate businesses with technology in the mix. The various sectors provide entrepreneurs with extensive customer reach, which lets them grow their businesses successfully.

- Liability Protection: Business owners in Florida who choose LLCs benefit from legal assets protection, which protects their personal wealth against business debts. Legal issues affecting your business cannot impact your personal finances when you operate through an LLC.

- Credibility: Establishing your company as an LLC in Florida increases its professional reputation with stakeholders. Companies that register as LLCs in Florida earn better professional and trustful reputations among customers, investors, and suppliers in the state. The transparent business regulations of Florida help make it a trusted centre for commercial operations.

Is an LLC in Florida Right for You? Potential Drawbacks

The formation of an LLC in Florida comes with numerous benefits, yet several potential negative points need recognition:

- Ongoing Fees and Taxes: Florida maintains one of the most affordable tax rates among all U.S. states. The business expenses of LLCs remain taxable to state institutions, yet the introduction of employees or particular revenue streams might trigger supplementary tax registration.

- State Regulations: Companies operating in Florida must follow both state and local regulations that may present complexities according to business type. Running a business entails confronting difficulties linked to compliance with environmental and employment regulations. Legal professionals commonly recommend businesses seek their help when accessing such complex regulations.

- Ongoing Compliance: Florida LLCs need to submit annual reports for continuous compliance status. Failure to submit reports on time, coupled with neglected deadlines, would lead to penalties and the potential dissolution of the LLC.

What to Do After You’ve Set Up Your LLC in Florida

You must perform these steps after your Florida LLC formation to maintain compliance along with operational readiness:

- Obtain an Employer Identification Number (EIN): An Employer Identification Number (EIN) serves as a necessary tax-handling tool to open business bank accounts. Any person can obtain this number free of charge by utilising the online application system on the IRS website.

- Register for State Taxes: The nature of your business activity requires you to enrol for essential state taxes, including sales tax alongside unemployment tax and corporate income tax. For registration purposes, you need to contact the Florida Department of Revenue.

- Obtain Necessary Permits and Licenses: Florida businesses must acquire every permit along with a license needed to perform legally. Your business needs essential permits such as sales tax permits together with health permits or zoning permits according to their specific nature. Check additional information at the Florida Department of Business & Professional Regulation.

- Maintain Your LLC’s Good Standing: File your annual report and keep accurate records to keep your LLC in good standing. All tax requirements must be fulfilled, while reports should be submitted before deadlines to prevent financial penalties. Find detailed instructions about LLC’s good standing at the Florida Division of Corporations website.

Frequently Asked Questions (FAQs)

How do I get an LLC in Florida

File your Articles of Organization online at the Sunbiz LLC e‑File portal.

How to create a LLC in Florida

Follow this guide to select a suitable name, appoint a registered agent, file Articles of Organization, create an operating agreement, secure an EIN, and maintain necessary compliance.

Do I need a lawyer to open an LLC in Florida?

A lawyer will not create your Florida LLC, but you should seek professional legal help when you need guidance in the process.

How much does it cost to start an LLC in Florida?

The process of establishing an LLC in Florida requires business owners to bear several expense categories.:

- Articles of Organization Filing Fee: $125

- Annual Report Filing Fee: $138.75 (due annually)

- Additional costs may include fees for registered agent services, business licenses, and permits.

How long does it take to form an LLC in Florida?

A business day period of 2–3 days is typically needed for online filing procedures. The delivery of mail submittals through the mail requires 1-2 weeks before completion. Business entities can choose expedited services to accelerate their application processing time.

Are there ongoing requirements for starting an LLC in Florida?

Florida-based Limited Liability Companies need to prepare and submit annual documentation in order to preserve their operating status. Not filing on time results in both financial consequences and leads to the dissolution process.

Conclusion:

Your LLC needs proper legal protection, which you must ensure through specific steps.

Establishing an LLC in Florida activates personal asset protection and increases organizational reputation. The required process, combined with compliance with state regulations, will lead your LLC to success. The full set of filing procedures, together with official documents, can be found on the Florida Division of Corporations and the Florida Department of Revenue.